Post-Merger Integration

L.E.K.’s Approach to Post-Merger Integration

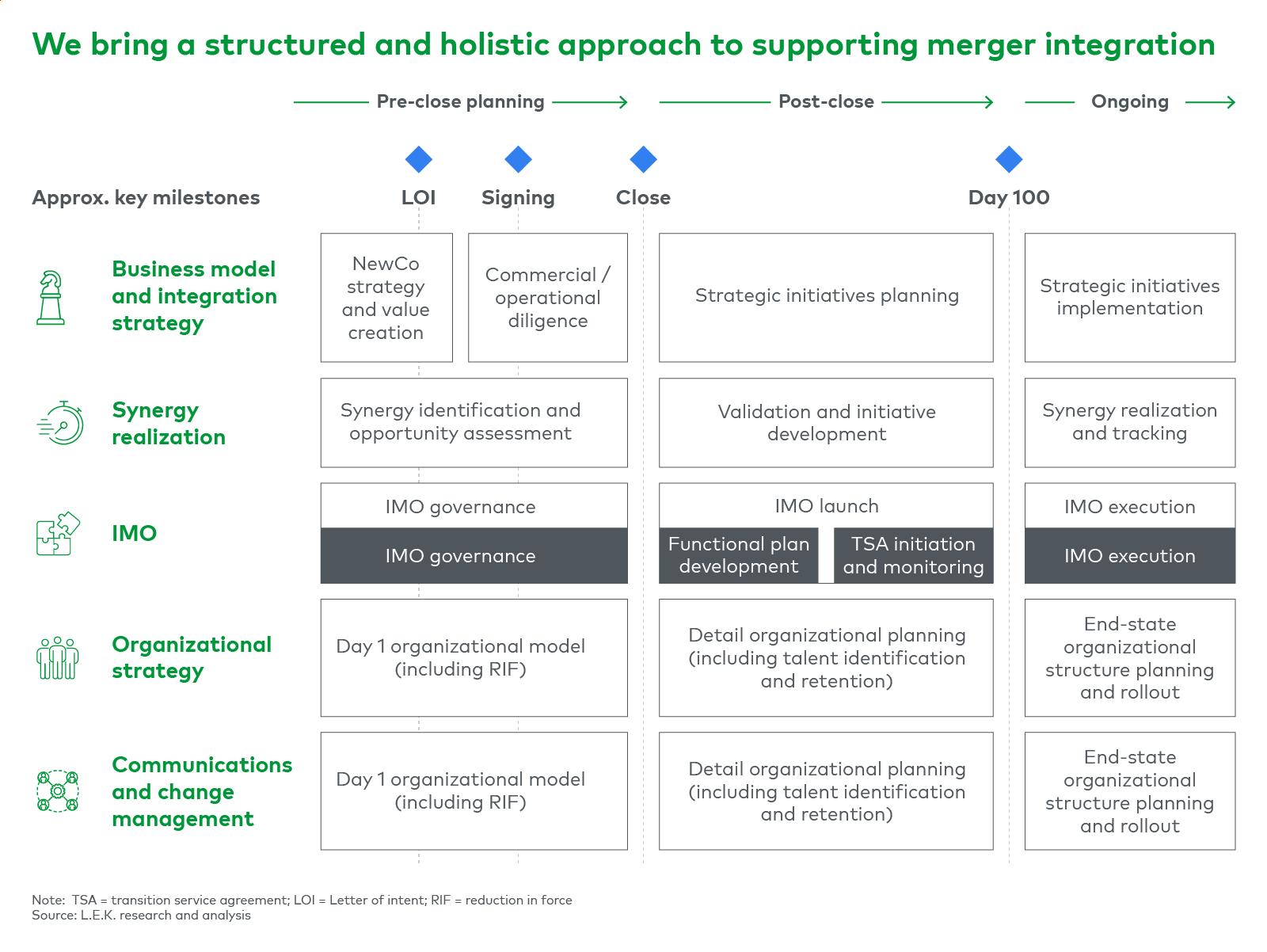

To create — rather than destroy — value during the integration of two or more companies, preparation is key. L.E.K. Consulting’s post-merger integration (PMI) specialists bring our deep market expertise to support the strategy, planning and execution required to realize M&A objectives. We work across the deal life cycle from large-scale global deals to mid-market mergers and “bolt-on” transactions. We help our clients achieve a smooth deal close process and ultimately a combined entity that is worth more than the sum of its parts.

Comprehensive method for driving integration value — supported by integrated management office

Our PMI practice brings both the experience needed to manage the integration process as well as the tools and techniques to catalyze the work. These include revenue and cost synergy assessments, “Clean Team” support, negotiation support, pre-close planning and analysis, post-close integration management, carve-out strategy and approach planning, and the development of transition service agreements. We combine our world-class market insights with appropriate planning and a structured approach to drive strategic, value-oriented integration for our clients.

L.E.K.'s PMI framework

How we maximize deal value through strategy-led PMI

Our suite of proven tools and our deep sector and M&A expertise allow us to accelerate any integration project:

- Business model and integration strategy. We combine our heritage as strategy consultants with proven integration guidance and support; our team takes a hands-on approach to guide you through key integration decisions and help you anticipate challenges, troubleshoot issues, and manage potential risks.

- Synergy realization. We bring deep industry expertise, world-renowned analytical capabilities and robust tracking tools to assess deal synergies, acting as a force multiplier for your team.

- Integration management office. Our extensive post-merger integration “tool kit” and industry-specific functional integration playbooks enable our clients to get up and running quickly.

- Organizational strategy. Tapping into our Organizational Strategy practice, we bring the latest tools and techniques to help clients develop an effective combined organization while retaining key talent.

- Communications and change management. Using our well-established communication program, we ensure internal and external stakeholder concerns are addressed.

A fit for purpose approach to PMI

Our global post-merger integration team advises on a wide variety of transactions — from large-scale global integrations to mid-market, carve-out and private equity (PE)-backed deals — across all our sector verticals. We bring a tailored, flexible approach to PMI so that you receive a fit-for-purpose support.

- Large-cap deals: Our experts understand the complexities involved in integrating companies across regions and countries and can deploy global coordinated teams to support our clients’ needs.

- Mid-market deals: We bring added structure, focus and speed to the deal while capturing value. We deploy deep strategic, commercial, organizational and operational expertise to help integration teams identify and evaluate synergy opportunities and develop integration plans that accelerate and amplify transaction value.

- PE-backed deals: Whether it’s a 100-day plan for a single acquisition, integration of “buy and build” assets or a carve-out, we can deploy a fit-for-purpose approach that focuses on rapid value creation and long-term capability development.

Rapid Integration Deployment

Are you facing roll-up strategy challenges? You’re not alone. Acquisition and roll-up is a common growth and diversification strategy for midmarket companies — and one that can yield myriad benefits. However, the challenges it poses are real and many.

L.E.K.’s Rapid Integration Deployment, or RID, enables a rigorous integration process that can be readily deployed for midsize businesses, and it’s fast. Learn more about how your midmarket organization can rapidly deploy a fit-for-purpose integration engine that will enable the execution of one transaction or many.

Optimize performance – Streamline success

Identify inefficiencies, reduce costs, and build agile, scalable processes that drive sustainable growth. Whether you're facing logistical bottlenecks, inventory imbalances, or supply chain disruptions, we deliver actionable strategies backed by data and deep industry insight.

Start a conversation with us today to see how improved operations can sharpen your competitive edge.