Acquisition and “roll-up” is a common growth and diversification strategy for many midmarket businesses. Such a strategy offers the potential for rapid growth, economies of scale (both cost and revenue), and the chance to diversify across geographies or customers and build a strategically superior position. In highly fragmented industries that are consolidating, it can also offer arbitrage opportunities.

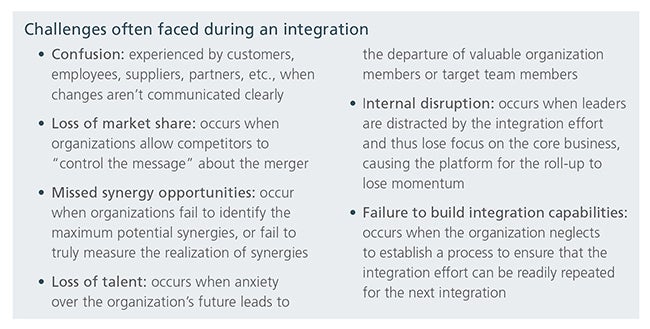

However, the challenges of a roll-up strategy are real and many (see sidebar). War stories abound with examples of integrations gone awry — customers lost, valuable team members lost, cost overruns, synergies never truly realized. Moreover, a failure to successfully integrate an initial acquisition can compromise the overall roll-up strategy, undermining stakeholder confidence and discouraging the next round of merger partners from taking the risk.

These challenges are most acute for midmarket acquirers because, while integrations can be complex regardless of size, small and midsize firms typically lack integration capabilities and capacity. For example, the vast majority of midmarket companies do not have a built-in team dedicated to shepherding an acquisition through to completion. Indeed, they typically have few employees who have ever been part of an integration effort. Moreover, midmarket management teams often run lean and simply do not have the capacity to manage and grow the core business while simultaneously driving an integration program.

So, what do you do if you and your team don’t have extensive experience with managing an integration process? How can you be sure that you can achieve all the objectives of the integration and realize all the synergies? How can you be sure you won’t destroy value at the company you’re acquiring?

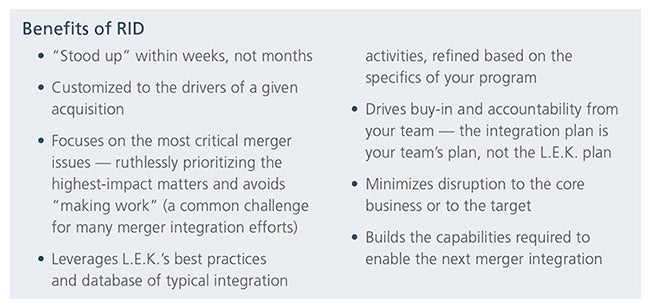

At L.E.K. Consulting, we have developed a process for quickly and efficiently establishing a merger integration “engine” for our midmarket clients. L.E.K.’s Rapid Integration Deployment process, or RID, enables a rigorous integration process that can be readily deployed for midsize businesses, and it’s fast. It is built on our years of merger integration experience (with businesses large and small) but is customized to meet the particular needs of midsize businesses.

Establish the foundation

It is critical to rapidly set the tone and structure of the integration. Clear integration principles and guidelines ensure that the teams prioritize activities in the right manner and enable decision-making to happen freely and in line with overall objectives. Establishing baseline synergies (cost and revenue) early gives immediate focus and ensures absolute clarity about what must be achieved and how success will be measured. From here, the work needs to be sufficiently organized by establishing the integration program’s overall governance and — critically — by defining the appropriate workstreams and ensuring that the right people are formally assigned responsibilities across the whole integration program.

L.E.K. can accelerate this process by bringing to the table typical structures for an integration effort and leveraging our deep experience in synergy drivers across many functions and industries.

Develop the workstream plans

Before the integration work can be truly done, the integration plans must be developed — “plan the work, and then work the plan.” This is often the hardest part of an integration effort for a midmarket business: The team must determine what integration priorities need to be planned and how to develop rich plans.

To aid in this, we leverage our database of typical integration plans and the long list of activities that might be applicable to a given plan, and from this starting point, a fit-for-purpose set of integration plans can be developed. Leveraging this accumulated information kick-starts an integration at the very point where many midmarket businesses lack the capability and capacity to move forward.

Stand up the integration process

As plans are being developed, it is critical to put in place the processes the business will need to “work the plan.” It is easy at this stage for process to trump content, but do not let this happen. In our experience it is important to ensure that the process does not become the end in itself, as it so often does in failed integrations. Simple processes (e.g., regular review sessions, standard planning tools, reporting by exception, a small IMO) are typically all that is needed for a midmarket business to successfully guide an integration.

Execute the integration

Once the plans and processes are in place, executing the integration should be an ongoing and iterative effort. Execution is not limited to the IMO but devolves to those responsible for executing the integration plans. However, an IMO typically plays the critical role of coordinating the overall effort and providing robust challenges to all participants in the integration program. In our experience, it is critical that there be an uncomfortably fast pace to the integration execution — this is typically facilitated by a weekly review rhythm that creates a sense of urgency and action.

Managing an integration process is never one size fits all; every situation is going to be unique and will require a bespoke approach. However, with the RID process, midmarket companies can rapidly stand up a fit-for-purpose integration engine that will enable the execution of one transaction or many.

Case study: Creating an integration engine for a business services client

Client situation

- Our client was a private equity-owned provider of facilities services; the company’s strategy was to acquire a range of small and midsize competitors to add to its portfolio of capabilities and quickly expand the end markets served.

- However, management recognized the company’s inexperience with acquisition and the risk that an unsuccessful process would create.

- Management asked L.E.K. for assistance to quickly stand up an IMO to assist with the pending first transaction and create organizational capabilities to manage future transactions.

L.E.K. process

- We used our IMO development process to assess the key success factors for integrating sales, operational and back-office functions; bespoke functional integration plans were co-created with the client teams.

- A monitoring, reporting and governance structure was created to provide for maximum communication and flexibility while minimizing the burden on functional and executive leaders.

- We also assisted with the development of a synergy assessment and tracking process and with estimating synergies associated with the first transaction being considered.

- Our team supported functional leaders during the execution of the first transaction and provided the long-term tools and capabilities for the client to manage future integrations itself.

Results

- The first acquisition was executed smoothly, with key timetables met and early synergy milestones achieved.

- The client team began immediately using the tools and processes we helped facilitate for additional acquisitions in the pipeline, and within four months, the company had closed four additional transactions and had increased topline revenue by over 60%.

Contact

Simon Horan and Dan Horsley, Managing Directors in L.E.K. Consulting’s Organization & Performance practice, produced Rapid Integration Deployment: Realizing M&A Potential. For more information, contact organization-performance@lek.com.

12182018081220