Dynamic Performance Management

The benefits of dynamic performance improvement

Every part of an organization creates metrics to track their performance. But the downside is that organizations become swamped by a mountain of key performance indicators (KPIs) and management dashboards that end up being little more than a distraction. In fact, only a few KPIs have a major influence on cash flow, but arriving at a full understanding of those key metrics and how they interact with one another often proves elusive.

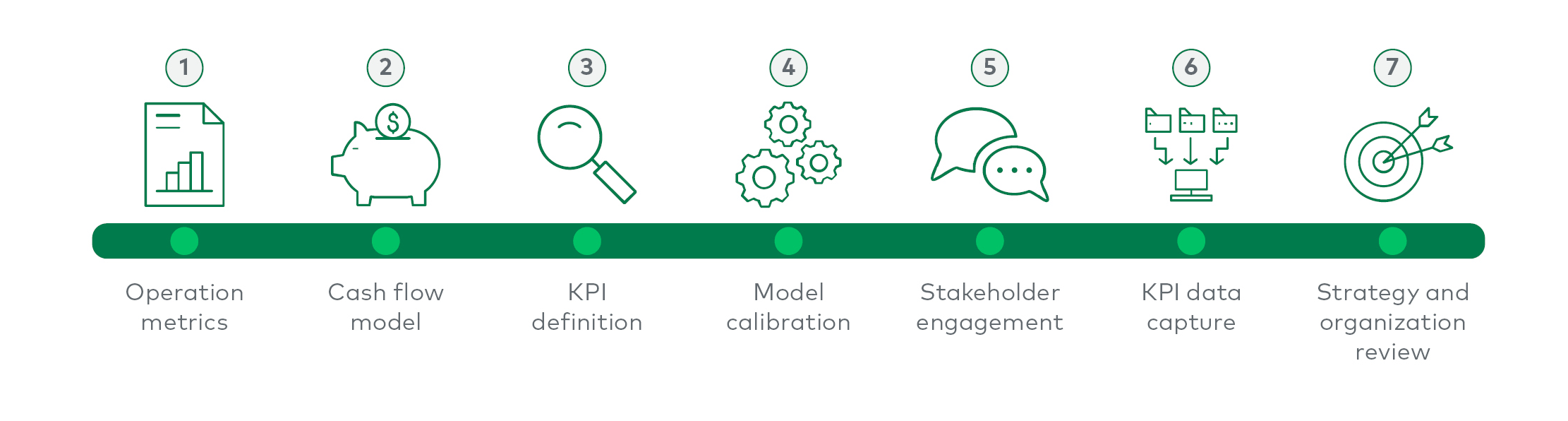

To address the problem, L.E.K. Consulting has developed Dynamic Performance Management (DPM). This rigorous analytical framework uses a seven-stage process to create genuine insight into a company’s critical KPIs and can become a catalyst for a step change in performance, organizational redesign, strategy refresh and continuous improvement. In our experience, it is reasonable to expect this process to deliver profit improvement opportunities more than 30%.

L.E.K. DPM framework: seven-step process to profit enhancement

The benefits of the DPM process are far-reaching:

-

Immediate performance improvement by focusing on KPIs that can be improved the most

-

Dramatic increase in understanding and collaboration between business domain leaders

-

Faster evaluation of alternative strategic scenarios using simple assumptions about operational metrics

-

Alignment between real-time management information, budgeting and longer-term planning

-

Immediate quantification of investment decisions based on the planned consequences for KPIs

-

Catalyst for a complete refresh of strategy, organization and culture

-

Opportunity to renew incentives and reward mechanisms linked directly to KPI improvements