Introduction

While the state of digital health of European hospitals varies widely within and across countries, hospitals are generally growing their investments in digital solutions that increase efficiency and productivity among short-staffed hospital teams and meet patient expectations of greater digital engagement post-COVID-19.

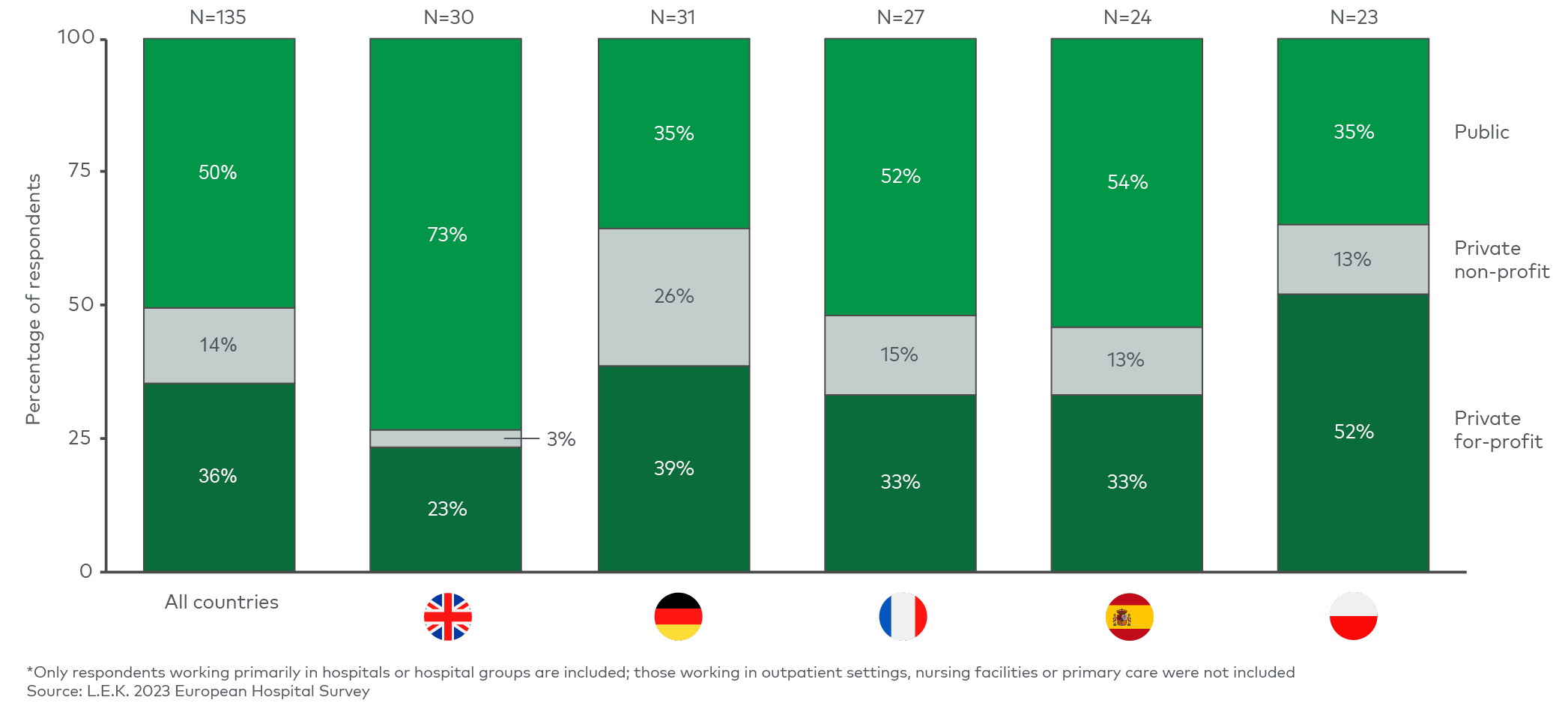

The UK, Netherlands and the Nordics have typically invested in digital hospital infrastructure to a greater extent and are more advanced than other European countries. In the UK, the National Health Service (NHS) has driven the majority of investments, aiming to improve efficiency, productivity and patient outcomes. Early funding programs run by NHS England aimed to support more widespread digitisation in hospitals, including the Digital Exemplar and Digital Aspirant programs. Additional digital health funding was put towards digitising integrated care systems (ICS), which partner multiple organisations involved in local care delivery and were established in 2022.

Germany lags other countries due to its historically low investment in digital hospital infrastructure. This was evident in the 2022 Healthcare Information and Management Systems Society’s DigitalRadar survey, which in its interim report showed that only c.1% of German hospitals were rated in the upper levels (three or above) of the Electronic Medical Record Adoption Model scale of digital maturity, and none were at the top levels of six and seven, indicating a significant lack of digital information systems in hospitals to support clinical care processes. Acknowledging the need to address this digital shortfall, the German government launched the Hospital Future Fund (Krankenhauszukunftsfonds, or KHZF) in September 2020, providing up to 4.3 billion euros (co-funded by the federal government, federal states and hospital operators) to accelerate digital development. Federal states submitted their applications for funding before the end of 2021, and the second Hospital Future Act (Krankenhauszukunftsgesetz, or KHZG) evaluation of the status of digitisation of hospitals receiving the funding is likely to happen in 2024.

French hospitals are also somewhat behind UK hospitals, despite gradually improving their digital maturity over the past c.10 years. In 2021, for example, the health minister announced a plan to invest 650 million euros towards the country’s national digital health strategy. Hospitals have been gradually modernising and integrating their systems, in part due to consolidation from the continued formation of regional hospital groups (Groupements Hospitaliers des Territoires) in the public sector and M&A in the private sector. The trend towards hospital digitisation is expected to continue, with some investments focusing on improving the inflow of patients from primary care, particularly for private hospitals looking to ‘win’ share of patients.

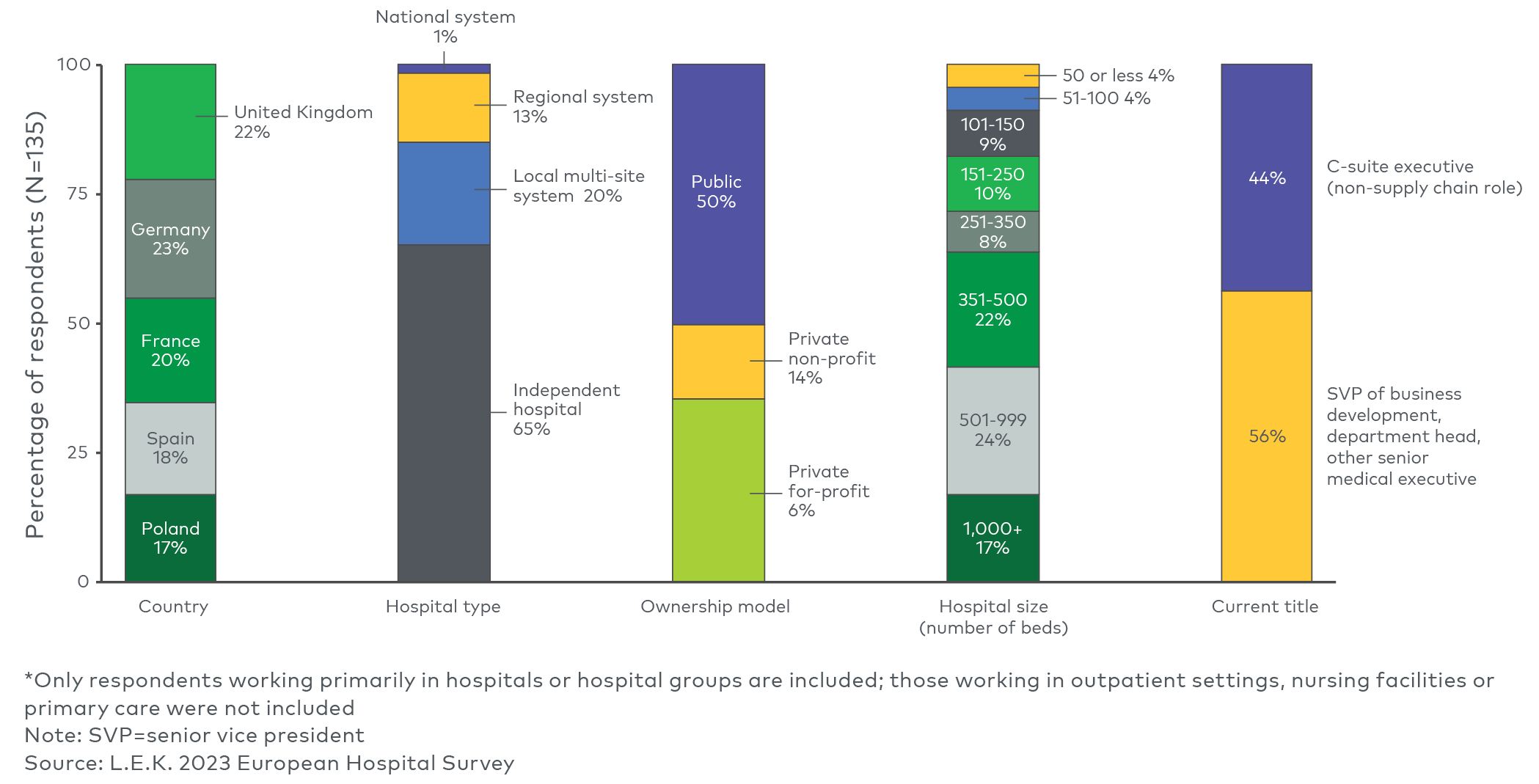

In this Executive Insights, L.E.K. Consulting discusses the state of digital health within European hospitals, including investment priorities going forward and implications for hospitals and their digital and IT suppliers. The data are informed by L.E.K.’s 2023 European Hospital Survey of hospital executives and directors in the UK, Germany, France, Spain and Poland covering the following areas of digital health (see Figure 1).