What’s Next for FedNow: Future Impacts and Predictions

- Article

The launch of the FedNow instant payments service could have a significant impact on the financial services and payments infrastructure as real-time payments become a critical offering for businesses and consumers. This article explores the widespread implications of FedNow’s 2023 national debut and its continued scaling over the next decade.

This is the third installment of our three-part series exploring the monumental impacts of the Federal Reserve’s new FedNow instant payments service. If you haven’t already, go explore:

The availability of instantaneous money movement through FedNow will fundamentally change payment behaviors and expectations. Consumers will grow used to the speed and convenience of real-time transactions, moving away from traditional delayed payment methods and causing demand to increase for fast settlement across all transaction types as financial planning also adapts to immediate access to funds. As consumer expectations change, banks and payment providers will need to meet these expectations for instant payment solutions.

Businesses will also benefit from FedNow’s accelerated cash flow and flexibility in payroll, vendor payments and reimbursements. Industries primed to be early adopters of FedNow include:

FedNow’s faster processing times could reduce cart abandonment rates, which may lead to improved customer experiences and increased conversion rates. By streamlining payment processes, ecommerce businesses might be able to enhance customer satisfaction and drive sales growth.

Real-time payments through FedNow facilitate instant payouts for gig workers, providing greater financial flexibility and a potentially enhanced overall experience. This could improve worker satisfaction, increase productivity and contribute to the growth of the gig economy sector.

FedNow might enable retailers to achieve faster inventory turnover, improve cash flow management and optimize working capital. With the ability to access funds quickly, retailers can manage their inventory more effectively and respond swiftly to market demands.

However, while the efficiencies are promising, reliance on real-time systems poses risks of transaction errors, fraud and operational disruptions that businesses must address.

Other major industries face unique opportunities as well as challenges:

Industry | Key changes | What to watch out for |

|---|---|---|

| Insurance |

|

|

| Wealth management |

|

|

| Payment services |

|

|

Over 300 financial institutions have onboarded the FedNow platform since its mid-2023 launch. Acceleration should continue as FedNow triggers a ripple effect prompting rapid, competitive adoption of instant payment capabilities. The real-time payments market is projected to continue growing as transactions shift to instant payment rails.

Specific projections of changes resulting from FedNow’s continued growth include:

Accelerated RTP network adoption: FedNow’s launch will trigger a domino effect driving broad real-time payments integration. Its debut in consumer use cases will likely catalyze an increase in person-to-person (P2P) and business-to-business (B2B) real-time money movement.

Mass network connectivity: Because there are almost 8,000 U.S. banks and credit unions, achieving full integration may take up to a decade. Over this extended period, expanding connectivity can translate to improved customer access and convenience through faster payments and transfers.

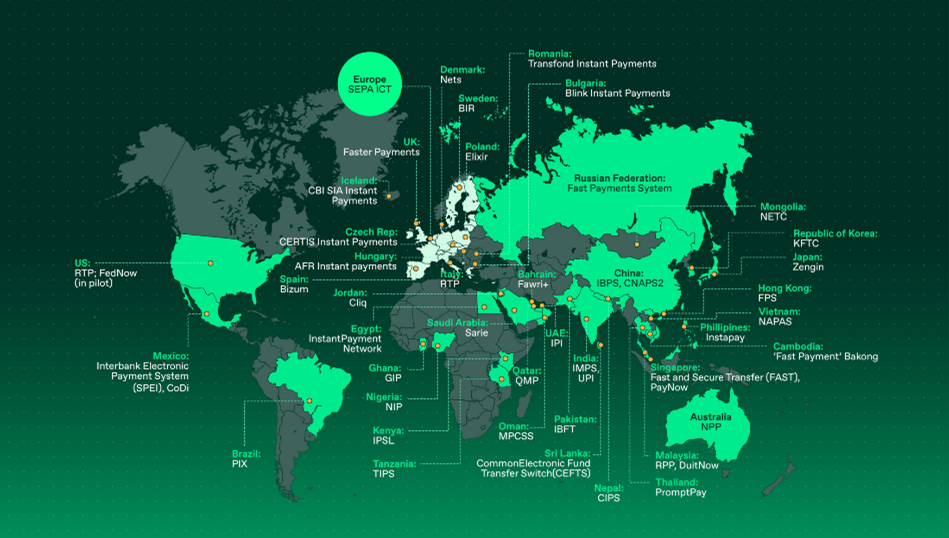

Replacement of legacy payment methods: FedNow could gradually shift volume away from cards, wires, ACH and other payment rails. Experts predict heavier initial impacts on B2B transactions like invoicing and vendor payments that value real-time speed and finality. Over time, consumer and business transactions could migrate to instant options across P2P and bill pay as adoption scales (see Image 1).

Image 1: Global real-time payment adoption

Source: Thunes.com

The rapid uptake of real-time payment systems worldwide, such as UPI in India and PIX in Brazil, demonstrates the increasing demand for instant transfers as a standard expectation. In the U.S., the introduction of FedNow, alongside other real-time payment methods like the RTP network and Zelle, is driving this shift toward real-time money movement becoming a baseline standard.

In the wake of FedNow’s launch, decision-makers are presented with strategic considerations covered in each part of our series on FedNow:

These insights are intended to help decision-makers navigate the introduction and integration of FedNow effectively, ensuring they are well-positioned to lead their organizations into a future defined by instant, secure and efficient payments. To discuss how L.E.K. can help prepare your organization for the future of real-time payments, evaluate infrastructure modernization needs and develop innovative growth strategies amid disruption, reach out to technology@lek.com.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2024 L.E.K. Consulting LLC

Bibliography

“Accelerating the Future of Payments with FedNow.” Sila, 2023.

“Advances in Real-Time Financial Transactions.” Journal of Big Data, 2020.

“Emerging Trends in Real-Time Payments.” ScienceDirect, 2021.

“FedNow: Game Changer for U.S. Consumer Payments.” Flagship Advisory Partners, 2023.

“FedNow: Payments Innovation.” St. Louis Fed, 2023.

“FedNow: The Evolution of Real-Time Payments and the Consumer Experience.” Position2, 2023.

“FedNow 2023: 300 Participating Financial Institutions.” Federal Reserve Services, 2023.

“FedNow Concerns.” Unit21, 2023.

“FedNow Payments Capabilities.” PwC, 2023.

“North America Freight Insights.” C.H. Robinson, 2023.

“Real-Time Payment Systems and Financial Markets.” SpringerLink, 2021.

“Should card issuers fear FedNow’s impact on revenue?” American Banker, 2023.

“Tech Vision for FedNow.” Federal Reserve Services, 2023.

“The Impact of Real-Time Payments on Banking.” Journal of Big Data, 2020.

“The Rise of Real-time Payments: Understanding the Technology and Benefits.” Thunes, 2024.

“The RTP Gold Rush: 10 FedNow Predictions.” Forbes, July 19, 2023.