This article is the second installment in our three-part series exploring the monumental impacts of the Federal Reserve’s new FedNow instant payments service. In Part I, we provided a broad overview of FedNow’s infrastructure and who stands to benefit.

Now, in Part II, we dive deeper into the critical implications and decisions facing financial institutions as they integrate this new transactional ecosystem. From managing rising costs to adapting operations for 24/7 settlement, we reveal key insights for banks gearing up for the new instant payments era.

Introduction

As consumer demand for faster digital payments grows, the Federal Reserve has taken a major step to meet these needs with the launch of its FedNow Service. FedNow is an instant payments service that enables near real-time fund transfers between bank accounts, bringing U.S. payment capabilities into the 21st century and offering financial institutions an alternative to The Clearing House’s real-time payments (RTP) network.

While promising increased speed and access, FedNow also surfaces pressing considerations for infrastructure upgrades, liquidity management and deployment strategies.

In this article, we explore these critical implementation challenges. As FedNow shapes the terrain ahead, our guidance aims to prepare banks to align with the future of instant payments.

Understanding the costs for banks

In July 2023, the Fed introduced the FedNow Service with a pricing model designed to incentivize rapid financial institution adoption. The structure included waiving all fees in 2023, offering discounts on the $0.045 customer credit transfer fee (sending fee) for the first 2,500 transfers per month and waiving the $25 monthly service fee per routing transit number (RTN) account. In 2024, the fee schedule changes to include the $25 monthly participation fee, a $1 liquidity management transfer fee, a $0.01 request for payment fee and a $0.045 return customer credit transfer fee (for rejected/declined payments).

These changes reflect the Fed’s efforts to support the widespread adoption of instant payments while adjusting the fee structure to ensure cost recovery and continued investment in modernizing infrastructure and advancing payment security and resiliency.

FedNow Pricing Schedule, 2023-2024

Fee | Metric | 2023 | 2024 |

|---|

| Participation Fee | Per RTN/month | Waived | $25 |

| Credit Transfer Fee | Per transaction | $0.045

(2,500+ transactions) | $0.045 |

| Credit Transfer Return Fee | Per transaction | $0.045 | $0.045 |

| Request for Payment Fee | Per transaction | $0.01 | $0.01 |

| Liquidity Management Transfer (LMT) Fee | Per transaction | $1 | $1 |

Source: FRB Resources

The Private Sector Adjustment Factor

The Private Sector Adjustment Factor is included in the price of the Fed’s services, including FedNow. This factor accounts for hypothetical tax obligations and profit margins if a private firm were to offer the same services, thus preventing the Fed from underpricing private competitors.

The assessment of this fee is based on the volume and type of transactions processed through FedNow every year. Covering these imputed expenses, which are factored into the pricing of Federal Reserve services, necessitates investment in areas like real-time systems, security protocols and regulatory compliance. Smaller institutions may require third-party solutions to manage these requirements, as they may have limited resources compared to larger banks, making it relatively more challenging for them to make these investments.

Infrastructure and implementation expenses

Beyond explicit fees, significant implicit costs for instant payment adoption exist around implementation and ongoing operations. These include integration with existing systems, procurement of compatible hardware and software, extensive testing, troubleshooting and staff training. Smaller institutions, which may have limited resources compared to larger banks, can find these expenses particularly challenging to manage. As a result, they may need to seek third-party solutions to facilitate the integration and management of the necessary infrastructure and operational requirements.

Operational expenses and economies of scale

Legacy payment systems centrally managed by large consortiums previously created advantages of scale for bigger banks regarding transaction costs. Smaller community banks lacked the volume to negotiate lower processing rates.

FedNow’s pricing and accessibility provide economic parity. Combined with turnkey integration through third-party fintech solutions, regional institutions can achieve the scale necessary to compete.

Managing liquidity and operational changes

The introduction of FedNow presents a new paradigm for banks regarding liquidity management and operational agility. This 24/7/365 operational model necessitates a radical departure from conventional banking practices, characterized by defined operating hours and batch processing.

Challenge of liquidity management with instant settlements

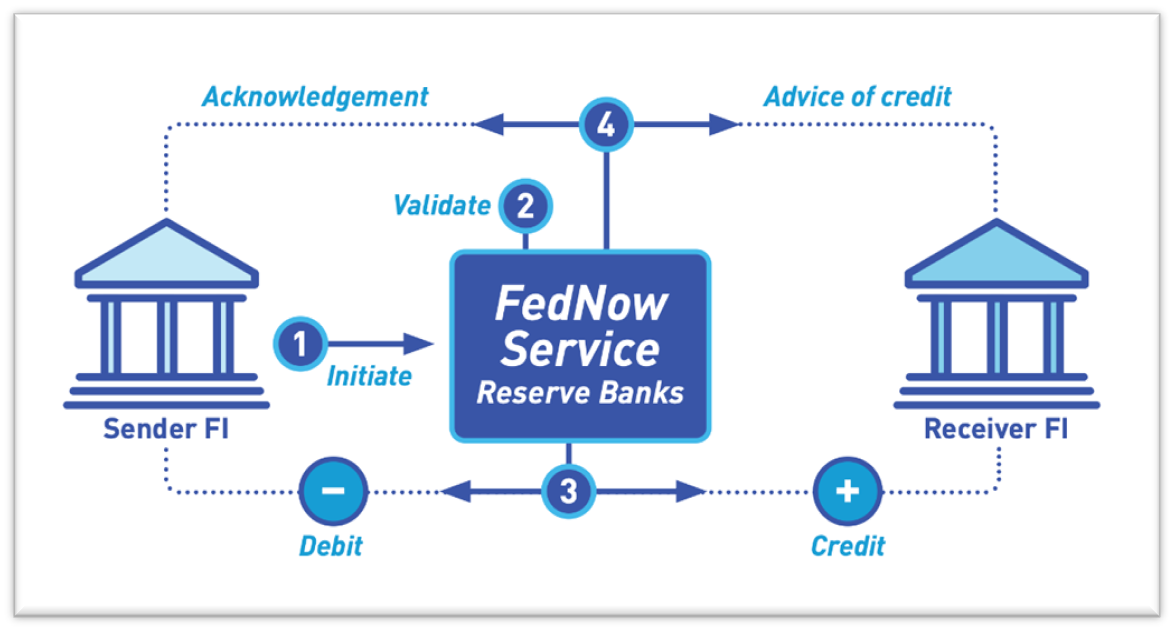

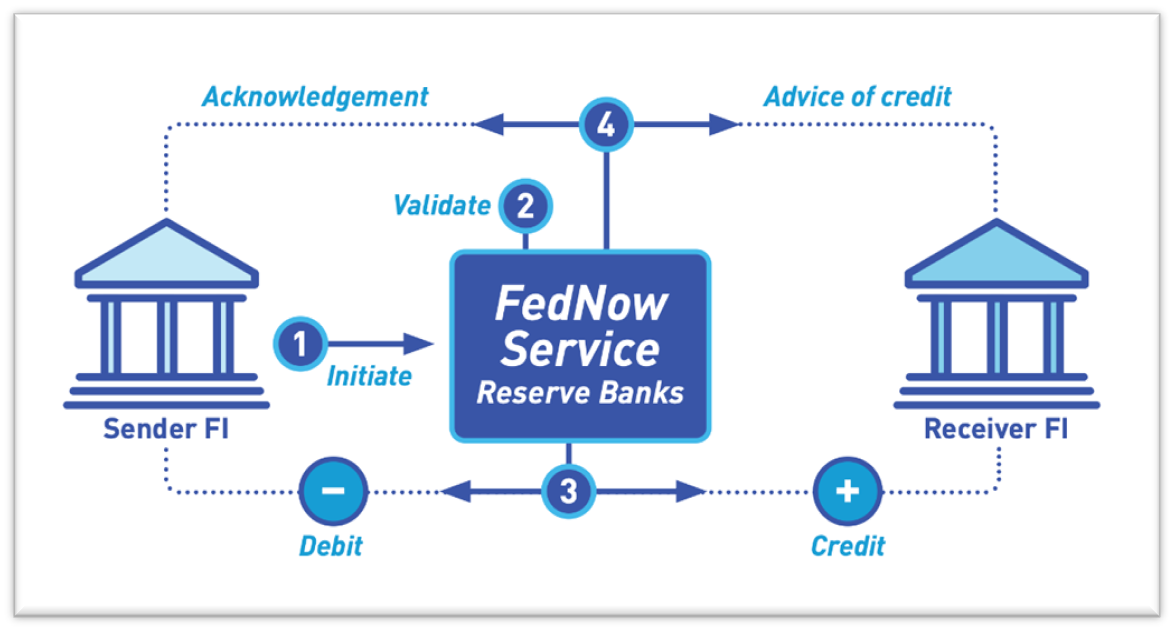

With FedNow, banks must have adequate funds available at all times to meet the demands of immediate transactions. To address this shift, FedNow offers a liquidity management transfer (LMT) feature. This feature enables immediate fund transfers between financial institutions to manage liquidity in real time and ultimately support payments through FedNow.

LMT example: A small bank experiences a sudden surge in instant payments, leading to a temporary cash shortfall. The bank can utilize the LMT feature to immediately transfer funds from its account at a larger institution or another bank to fill the liquidity gap.

How liquidity management transfers work

Source: FedNow

The LMT feature is also open to banks using private instant payment networks (such as Zelle and RTP) backed by a shared Federal Reserve account that exists to settle those instant payments. This means even non-FedNow participants can utilize the LMT feature. The inclusive design matches the Fed’s mission — promoting fair nationwide access for real-time payments regardless of bank size.

Operational changes for 24/7/365 adaptation

FedNow propels banking into an always-on paradigm where transactions are processed instantaneously around the clock. This departs from the traditional banking infrastructure centered on end-of-day batch settlement. Banks may need to shift away from outdated, mainframe-based banking systems and older payment processing platforms to comply with FedNow’s operational requirements.

Moreover, technological upgrades must align with cultural transformation across staffing models, training and leadership. Banks may need to evaluate 24/7 staffing coverage using rotating shifts or teams across time zones. Employees at all levels will require comprehensive training in managing real-time payment flows, handling customer queries and troubleshooting issues. Executives must champion and closely govern the operational overhaul, communicating changes clearly and measuring progress toward readiness.

Example: A bank experiences a surge in customer-initiated instant payments during a bank holiday. Staff will need to be on call to address any issues with the transaction processing system and be available to manage more complex issues that may arise.

Banks can smoothly transition from yesterday’s batch processing to the future of real-time banking with comprehensive systems, staffing and culture alignment.

Interoperability with existing systems

As FedNow goes live, interoperability with existing rails like RTP takes central importance to maximize access and utility. The Fed aims to technically interconnect FedNow and RTP, holding discussions with The Clearing House toward this goal.

Further efforts are underway to bridge FedNow and other private networks. Key areas of focus include:

- Transaction mapping: Enabling communication among the messaging formats, data standards and API structures across systems to allow the transfer and interpretation of payment instructions and confirmation notices.

- Settlement interlinking: Bridging the settlement mechanisms and liquidity infrastructure underlying the rails through alignments or joint interfaces to enable fund movement visibility and reconciliation.

- Security alignment: Ensuring aligned identity verification, fraud detection and cybersecurity measures across the systems to uphold integrity and trust.

- Regulatory reporting: Building integrated reporting standards and benchmarks across networks to satisfy oversight requirements around transactions, availability and risk.

Delivering this interoperability demands collaboration among individual banks, banking consortiums like RTP’s operator, The Clearing House, the Fed and technology partners. The competitive landscape also raises interoperability urgency with customer experience and access at stake.

Elevating the customer experience

Introducing instant payments via FedNow empowers banks to greatly elevate the customer experience. Financial institutions can now offer new value-added services catered to digital-first customer expectations and behaviors.

Key opportunities include:

- Real-time account funding: Customers can gain instant access to payroll, expense reimbursements, commissions and other incoming funds rather than waiting days for settlement finality, which grants more financial control and flexibility.

- Emergency money transfers: Customers can send to loved ones urgent cross-border remittances or emergency funds that become available to recipients in seconds rather than days.

- Effortless peer-to-peer payments: Friends and family can instantly split bills, pay each other back and exchange funds as needed rather than having to schedule transfers and wait.

- Enhanced business services: Corporations can optimize cash flow with real-time vendor, contractor and customer payments, as well as leverage richer ISO 20022 data for reconciliation.

To make the most of these opportunities, banks should invest in educating customers while ensuring the same level of seamless security. Intuitive user experiences around these newfound instant payment functionalities will help drive adoption.

Key considerations for decision-makers

As we transition from specific industry implications to a broader market perspective, it’s crucial to consider the wider ramifications of FedNow’s integration into the financial ecosystem.

How can banks mitigate wider financial system risks?

Financial institutions must safeguard against systemic risks like accelerated bank runs triggered by FedNow’s instant settlements. During times of wider economic distress or market uncertainty, the immediacy of withdrawals could prompt consumers to rapidly pull deposits based on false rumors or irrational panic.

This risk intensifies given the increasing propensity for virality on social media. The rapid spread of information could ignite “digital bank runs,” as exemplified by the collapse of Silicon Valley Bank when customers pulled out $42 billion in deposits and prompted a bank failure in 48 hours.

Proactive contingency planning provides banks with the tools to counter such scenarios. Advance liquidity risk analysis models help forecast outflow surges so extra buffers are provisioned. Always-on transaction monitoring further detects abnormalities early. Customer communication preparedness also allows swift, targeted dispelling of inaccuracies fueling anxiety.

What regulatory considerations must be addressed?

The introduction of FedNow underscores the need for updated regulatory frameworks tailored to the nuances of instant payments. This involves close collaboration between regulatory bodies and financial institutions to navigate new challenges in areas such as data privacy, cybersecurity, anti-money laundering and Know-Your-Client protocols in a real-time context.

Key focuses will include developing comprehensive guidelines for fraud detection, secure and authenticated transactions, transaction reversibility and establishing efficient dispute resolution processes:

- Fraud detection and prevention: Implementing advanced measures for identifying and preventing fraudulent activities.

- Transaction security and authentication: Ensuring each transaction is secure and properly authenticated.

- Transaction reversibility mechanisms: Creating processes to reverse transactions in cases of error or fraud.

- Efficient dispute resolution processes: Establishing systems for resolving disputes swiftly in line with the speed of transactions.

This complex, uncharted territory demands close collaboration between regulatory bodies and financial institutions to address entirely new challenges.

How can banks combat consumer misinformation?

As consumers adapt to new financial technologies, the risk of misinformation and misunderstandings heightens. FedNow may become conflated with cryptocurrencies, stablecoins or Central Bank Digital Currencies (CBDCs) by those unfamiliar with its nature as an interbank real-time settlement system. Early indications reveal existing confusion around FedNow enabling direct CBDC transactions or payments.

Banks can mitigate confusion through consumer awareness campaigns across communication channels like social media, videos, website FAQs and in-app guides. Staff should receive training on effectively explaining FedNow’s capabilities, security, costs and distinction from digital assets when queried. Call centers should have approved talking points around common questions prepared.

Targeted education for small businesses, key users like payroll firms and financially vulnerable groups also provides an opportunity to propagate accurate FedNow comprehension. With thoughtful clarification at scale on FedNow’s background and customer value, banks can build digital payment literacy and trust.

Preparing for the future of faster payments

Key challenges include navigating regulatory changes and addressing potential consumer confusion about this new mode of transaction. Effective communication and customer education are essential in this transition.

FedNow offers promising prospects for efficiency and growth, but it requires strategic adaptation and careful planning. Banks and financial institutions must embrace these changes with informed strategies to fully leverage FedNow’s potential. With decades guiding strategic transformations, L.E.K. Consulting helps clients capitalize on innovations like FedNow to build future-ready competitive advantages.

For more information, please contact technology@lekinsights.com.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2024 L.E.K. Consulting LLC

Bibliography

Cross River Bank, “Comparing RTP and FedNow,” Aug. 24, 2023.

Digital Commerce 360, “What the Federal Reserve’s FedNow Brings to Real-Time B2B Payments,” June 23, 2023.

Federal Reserve Bank Services, “FedNowSM Features: Settlement, Reporting and Liquidity Management,” 2018.

Forbes, “The Fed Is Rewiring The U.S. Payments System—What That Means For You,” Sept. 15, 2022.

Global Wealth Advisors, “Risk Management and Insurance.”

Indianapolis Business Journal, “New Instant Payment Network Could Help Smaller Banks Compete with the Big Guys.” April 28, 2023.

ModLogix, “Who Still Uses Legacy Software and Why?,” April 23, 2023.

Modern Treasury, “Why FedNow’s Real-Time Payments Will Change Everything,” April 18, 2023.

Modern Treasury, “Interoperability Between RTP and FedNow,” Nov. 16, 2022.

Payments Dive, “The Clearing House Prepares to Share the Stage with FedNow,” June 16, 2022.

PBS, “Bank Runs Used to Be Slow. The Digital Era Has Sped Things Up,” Oct. 6, 2022.

PYMNTS, “FedNow Is Live, But Banks Face Integration Decisions,” July 21, 2022.

St. Louis Fed, “FedNow: Payments Innovation from Your Central Bank,” Sept. 6, 2023.