The world of digital payments continues to evolve rapidly, with new technologies and systems emerging to meet growing consumer and business demands for speed, convenience and security. The latest development in the United States is FedNow, the new instant payment system available from the Federal Reserve. FedNow enables real-time fund transfers, enabling individuals and businesses to send and receive money instantly at any time.

Read on for an in-depth look at how FedNow will function and who stands to benefit most from this new payment infrastructure.

What is FedNow?

FedNow was launched by the Federal Reserve on July 20, 2023, with a staged rollout to allow gradual adoption across U.S. financial institutions. Banks and credit unions of all sizes can sign up and instantly transfer money for their customers at any time.

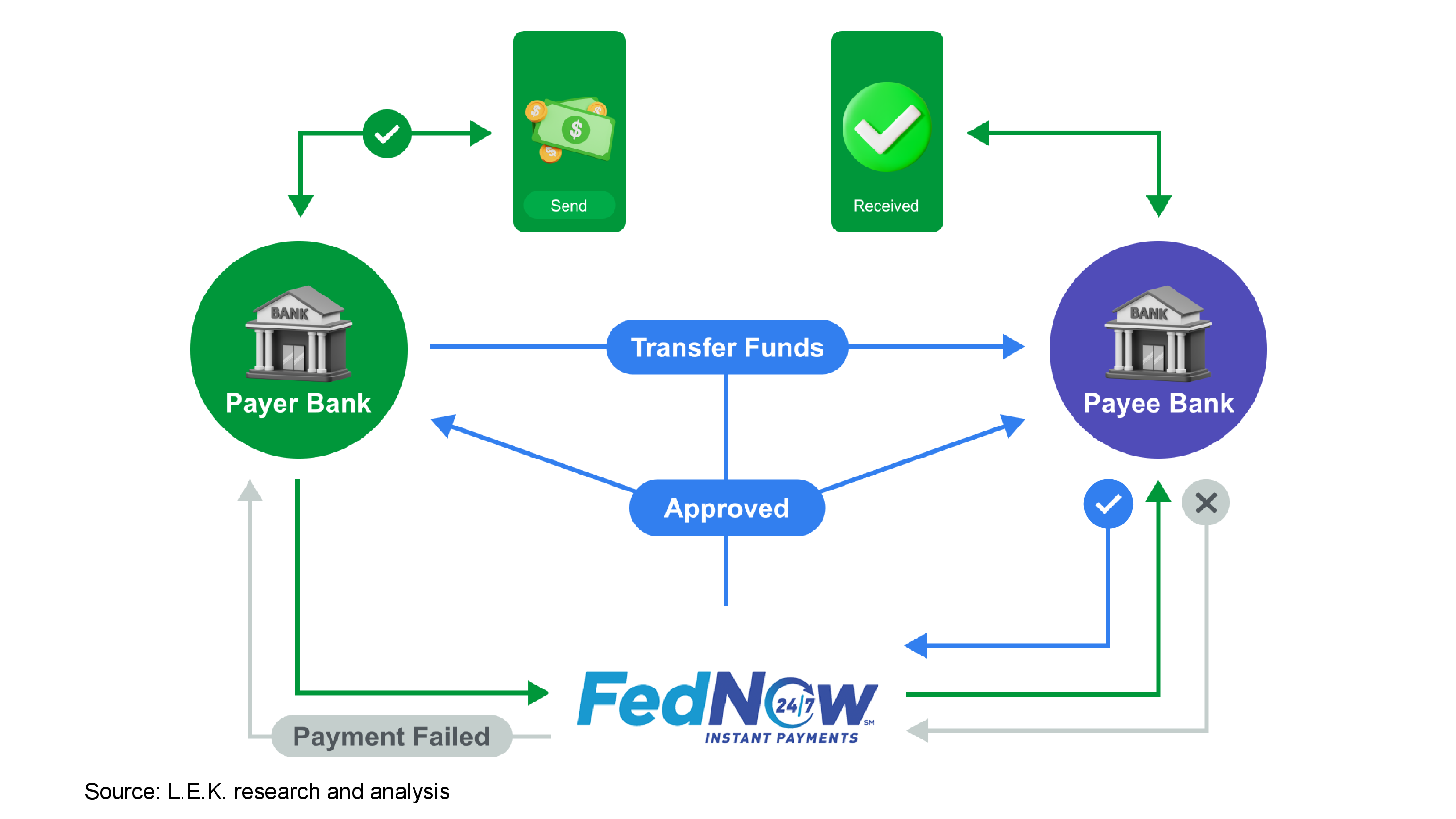

FedNow is the first instant payment system in the U.S. to be operated by the central bank, in contrast to private services like RTP and Zelle. This broadens the potential reach of FedNow’s instant payment capabilities since all federally insured banks and credit unions have access to the platform. FedNow utilizes a flat, transparent per-transaction fee structure, differentiating it from other systems using variable pricing models (see Figure 1).

Figure 1. How FedNow works: A diagram

Global instant payment capabilities

The U.S. is not alone in developing instant payment capabilities. In fact, over 50 countries have already implemented real-time payment systems — often with central government or central bank support — providing models for FedNow to follow:

-

Mexico’s CoDi system allows consumers to use QR codes to make instant payments from their mobile banking apps to merchants and individuals. CoDi was launched by Banco de México (Mexico’s central bank) in collaboration with consumer banks. CoDi has struggled to gain widespread adoption, with total payments reaching just 2.5 billion Mexican pesos ($15 million) in 2022.

-

In the UK, the Faster Payments system enables users to send and receive unlimited payments up to 250,000 pounds within seconds. Over 2.4 billion transactions went across this system in 2021. Features like “request to pay” and “assurable payments” are being introduced to further develop its capabilities. The system is managed by a consortium of banks with regulatory oversight from the Payment Systems Regulator, an affiliate of the Bank of England.

-

India’s immediate payment service (IMPS) provides users with instant domestic money transfers around the clock. IMPS was launched by the National Payments Corporation of India, an umbrella body set up by the Reserve Bank of India. In 2022, IMPS processed over 4.6 billion transactions worth 37,06,363 crore rupees (approximately $400 billion).

-

In Australia, a system called the New Payments Platform (NPP) went live in 2018, allowing real-time fund transfers between participating financial institutions. The NPPA has involvement from both the Reserve Bank of Australia and major private banks/financial institutions. In 2022, the NPPA processed 1.2 billion real-time payments.

-

In Brazil, Pix allows consumers and businesses to transfer funds between accounts instantly and free of charge. Launched in 2020 by the Central Bank of Brazil, Pix processed over 8 billion transactions in 2021. Pix leverages QR code technology, a centralized infrastructure and cellphone integration for easy adoption.

-

In Singapore, PayNow allows users to send and receive instant fund transfers using just a mobile number, national registration identity card number or entity number. Launched by the Monetary Authority of Singapore in 2017, PayNow processed over S$7.7 billion in peer-to-peer fund transfers in 2021. Integration with QR codes provides additional convenience.

These global systems demonstrate how instant payments are transforming finance and commerce around the world. FedNow aims to bring those same possibilities to the United States.

Who stands to benefit?

The widespread availability of instant payments through FedNow has the potential to benefit consumers, businesses and payment services providers in the United States.

Consumers

For consumers, FedNow enables instant access to funds like paychecks and transfers between individuals, allowing for improved cash flow management. Bill payments can be made at the last minute, helping avoid late fees. Money can be sent and received conveniently any time of day, whether across town or across the country.

Small banks

FedNow levels the playing field for small banks and credit unions to compete through real-time payments. Previously, large banks had advantages with proprietary tools like Zelle and intrabank transfers. Smaller institutions lacked those capabilities. FedNow’s centralized instant infrastructure now grants equal access. This expands the ability for small players to attract and retain customers by meeting demands for speed.

Businesses

Businesses can benefit through streamlined vendor payments and improved ability to manage working capital. Receiving invoice payments instantly from customers enables quick access to funds to cover operating expenses. Just-in-time payments through FedNow can support better outflows and inflows of cash. Businesses can also take advantage of request for payment (RFP) messaging and rich ISO 20022 data to optimize accounts receivable. ISO 20022 allows far more payment information to be transmitted than traditional data standards do.

Payment services providers

Payment services providers (PSPs) can develop new real-time payment products and services leveraging FedNow to attract clients. The integrated clearing and settlement through the Federal Reserve also minimizes risks compared to other models like RTP and Zelle, which rely on deferred net settlement. Additionally, FedNow’s nationwide reach grants PSPs more customer access points than do private systems alone. As with other businesses, PSPs can further capitalize the use of ISO 20022 for rich data exchange and RFP messaging to build value-added overlay services.

Realizing FedNow’s potential

While FedNow brings promise, its voluntary adoption and coexistence with RTP create uncertainty around uptake. Banks may integrate FedNow slowly compared to mandated systems abroad.

Strategically leveraging FedNow requires developing innovative use cases and seamless orchestration with existing payment channels. Organizations must adapt to capitalize on the opportunities real-time capabilities offer. Expert guidance on implementation and integration can help maximize value.

As the payments landscape evolves with FedNow, staying strategic will be key. L.E.K. Consulting has experience guiding clients to lead change and growth through new innovations like FedNow. Contact us to discuss your payments transformation.

For more information, please contact technology@lek.com.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2023 L.E.K. Consulting LLC

Bibliography

- Board of Governors of the Federal Reserve System. (2022). FedNow Service.

- Board of Governors of the Federal Reserve System. (2022). FedNow Service Frequently Asked Questions.

- Board of Governors of the Federal Reserve System. (2023). Federal Reserve announces that its new system for instant payments, the FedNow Service, is now live.

- ACI Worldwide. (2022). The FedNow Service and the U.S. Real-Time Opportunity.