Charting a path to sustained margin improvement

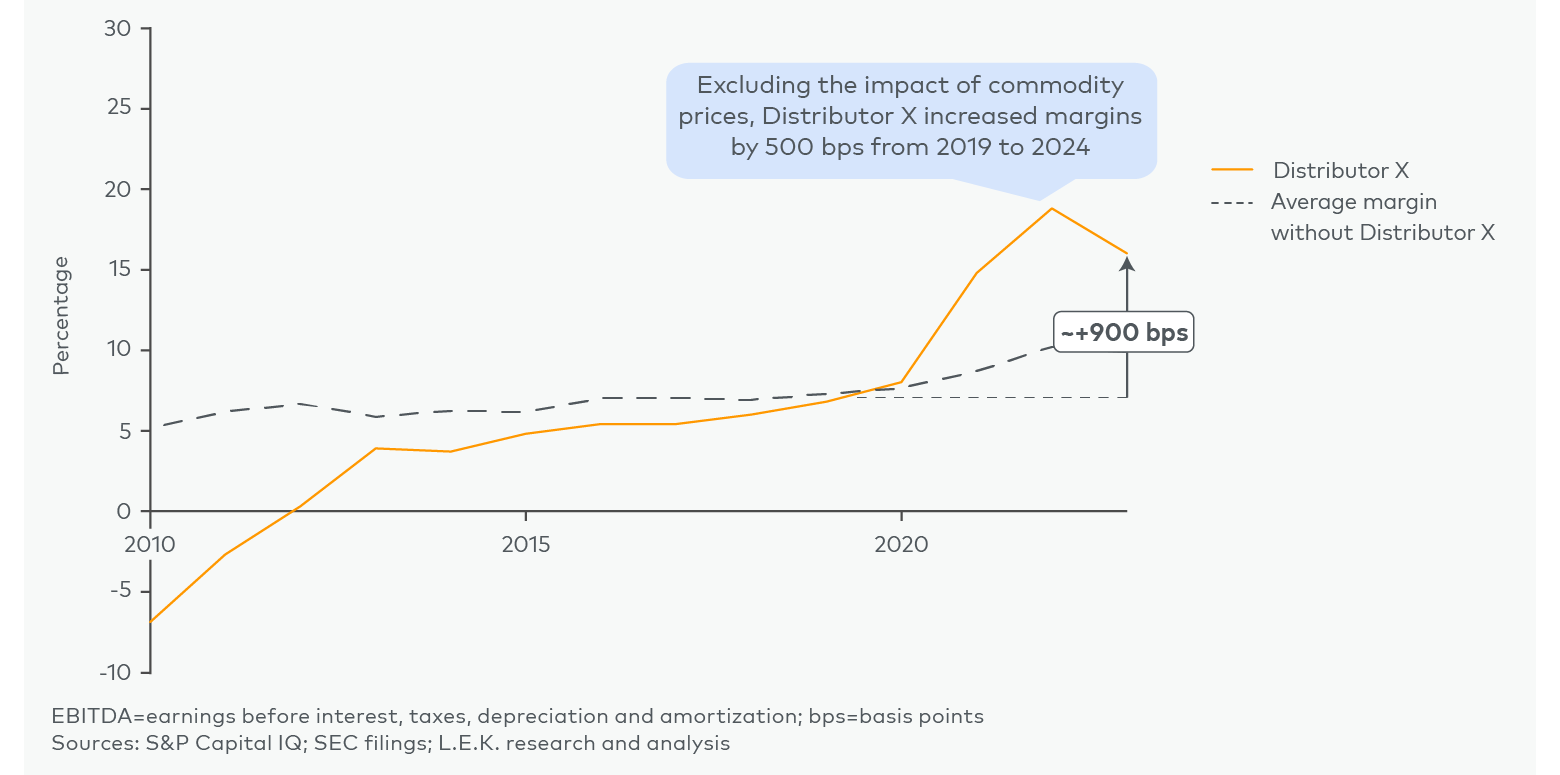

Building products distribution has enjoyed a decade of steady EBITDA margin expansion, thanks to a favorable macroeconomic environment, strategic M&A activity, and sustained demand in both the residential and commercial markets. But as margin gains become consolidated and new margin uplift becomes harder to achieve, distributors must shift from riding tailwinds to actively engineering further improvements.

The good news: Meaningful opportunities remain. By making the most of margin-rich product categories and pulling targeted cost and revenue levers, distributors can unlock the next wave of profitable growth. The path forward will require a realistic assessment of the time, capabilities and resources involved, with an eye toward achieving real impact in the medium term. If you are a distributor or investor seeking to improve margins and drive value creation, reach out to L.E.K. Consulting to discuss how we can help.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2025 L.E.K. Consulting LLC