Vendors are moving to provide a full stack view

Observability suites provide full IT stack visibility through a range of tools. Cloud network performance management (NPM), for example, analyzes network interactions with public/hybrid cloud networks or SaaS-hosted apps, while enterprise NPM focuses on packet loss rates, bandwidth utilization and other variables associated with network performance within local networks and/or on-premises data centers.

If an IT department could take a holistic view of its stack, from end to end, it would be able to understand how the various pieces interact with one another, which would enable the department to make informed decisions that would optimize those interactions. Besides, switching between multiple interfaces to arrive at an aggregated view of system performance across the full stack is deeply inefficient.

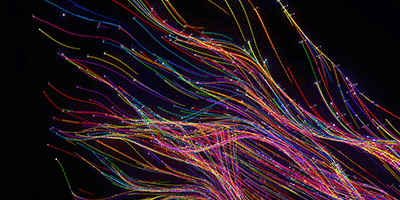

Vendors have begun addressing this complexity by expanding beyond their original areas of focus (see Figure 2). The landscape of observability solutions started as a mix of disparate products focused on different segments, with limited overlap across functionality, stakeholders and users. Among the solutions, some featured active and passive monitoring while others featured just passive. Now the greater complexity of applications, which itself is driving a need for more simplified, consolidated reporting, is causing those observability platforms’ use cases to converge.