Subscriptions can also be positioned as a club/community (think Dollar Shave Club); offering perks and discounts (e.g., “subscribe and save”) makes them more compelling than buy-as-you-go models. That said, one-time purchases can have their role. Some subscription businesses such as Prose, Function of Beauty (both personalized hair care brands) and Rent the Runway (rentable apparel), for example, also offer one-off purchases. Be it through flash sales or exclusive opportunities to buy, onetime purchases allow a brand to trial new products or even support partners with exclusive cross-sell opportunities. But generally speaking, the preference is to get subscribers.

2. Loyalty programs: As inflation and a potential recession cause consumers to cut back on spending — a recent Brand Keys study of 39 brand and restaurant categories found that 38% of them were seeing “declining” loyalty — retailers and brands are doubling down on loyalty programs. Rewards programs can be a core driver of loyalty; 79% of consumers in a recent Cheetah Digital survey said they’d prefer brands invested in such programs over social media marketing. So, while brick-and-mortar retailers and restaurants such as J.Crew, Starbucks and Burger King are overhauling their loyalty offerings, DTC brands are also starting to lean in.

Brands such as hair care company Prose (Prose Perks), fashion brand Rebecca Minkoff (RM Rewards) and menswear brand Mizzen + Main (Main Man Rewards) are among those offering loyalty programs that reward consumers with points for actions such as liking pages, filling out quizzes and simply making purchases — in the case of Prose, customers receive a free product after every 10 they buy as part of its program. While gamification can spur interaction, points that can be redeemed for offers/free gifts are attractive to consumers. However, to be successful, loyalty programs need to be easy to understand and have some degree of personalization. As a recent Salesforce survey found, 61% of consumers would use loyalty programs more often if rewards were automatically applied, 55% if rewards were personalized and 51% if tracking were easier.

3. Community building: Brand loyalty and stickiness are often the result of community building. Sharing product reviews, providing active chat sites for discussion and offering brand responses on social media or other platforms like Discord are common in industries such as beauty and fashion, as are consumers sharing product photos. Such community building not only engenders brand awareness, trust and a sense of belonging among consumers, it boosts customer engagement, loyalty and retention. User-generated content, surveys, polls, contests, reshares and live events also serve to build community around brands while generating active conversations between brands and consumers. Glossier and Sephora are two examples of brands that have successfully built community in the beauty space, while other brands have built community around social missions or consumer pain points (e.g., gluten-free).

Meanwhile, interesting new forays into community building can be found in the metaverse. American Eagle launched a “Members Always club” in Roblox for consumers to hang out in, for example, and lets them virtually try on jeans in its online stores. Meanwhile, Old Navy launched an incredible consumer-generated ad campaign based on crowdsourced ideas.

4. Personalized content delivery: The availability of consumer data now makes it possible — and advisable — to tailor content to individuals. Based on prior purchases, brands such as Ritual (personalized vitamins, minerals and supplements) suggest products that consumers “might also like” during browsing and at checkout to drive AOV. Using personalized emails and Short Message/Messaging Service (SMS) to prompt the next purchase is also critical. And in addition to knowing what a consumer might like, leveraging the details of when they last made a purchase and when — based on their history — they are likely to buy next can also encourage the purchase of personalized “it’s time to stock up” content. Even Sichuan food brand Fly by Jing, which uses puns and animations in its emails to make them feisty and fun, customizes them based on metrics such as what’s in a consumer’s shopping cart, how long they’ve been on the website, etc.

Some product categories — namely consumables that consumers run out of but are not always top of mind, such as deodorants or other hygiene products — naturally lend themselves to sending purchase reminders. Oh My Cream, a concept store that launched its own skincare brand, sends reminders to its customer relationship management (CRM) customers via email when it estimates they are nearly out of their product, an excellent opportunity to reengage and increase purchase frequency. Importantly, unlike with batch and blast models, emails and SMS should be used to surprise and delight, and to make a consumer feel part of the brand.

5. Soliciting and incorporating feedback: Understanding why customers return items and why they don’t is crucial. To find out, many brands simply ask them. Brands are increasingly doing exit surveys to understand why consumers are switching off subscriptions; for example, Lola (which makes women’s period and sexual health products) and Ritual (which makes DTC vitamins and supplements) both do so regularly. But asking isn’t enough; brands need to take that feedback and act on it.

Other good sources of actionable customer feedback include online reviews and customer service reports. Surveying existing customers (obviously not too frequently) is another great way brands can show genuine interest in their customers, build relationships with them and figure out what they need to do more of to keep them — from running additional customer satisfaction and product feedback surveys to conducting simple net promoter score check-ins. Brands such as meal kit provider Home Chef do this regularly. Others conduct user tests. Doing so allowed Daily Harvest (meal kits) to change the price/shape of its delivery boxes and related options to stimulate retention, for example.

Taking this concept a step further, some brands are actively encouraging customer input to help design their next product, be that by responding to initial feedback provided through surveys and comments or running campaigns to actively seek new product design ideas. This isn’t unique to DTC. LEGO turned around its business when it launched its ideas crowdsourcing platform in 2004, which received more than a million ideas and resulted in the launch of 23 new product sets that consumers helped design (those whose ideas were selected even got a cut of the profits). Brands such as DeWalt, Heineken, Coca-Cola and Unilever have made similar moves.

Another example, Asphalte, a digitally native vertical fashion brand based in France, launched in 2016 with an innovative business model that removes the need for inventory by selling pre-ordered clothes, online, that are co-designed with its customers; it manufactures product based on groups of orders, limiting waste and supporting local production. Each time a new prototype is launched, an email is sent to its customer base and promoted on social media to test consumers’ expectations, asking questions such as “Why do you have a sweater in your closet that you no longer wear?”

6. Getting the basics right: Some of the most common reasons customers cite for not reordering could be taught in a Retailing 101 class: a poor/slow delivery experience, product that is no longer in stock, a glitchy/slow website experience and/or purchasing process, unclear subscription terms — or those that don’t allow for any flexibility (e.g., pausing during vacations). In the tough environment we are currently in, mitigating some of that is tricky — think supply chain snarls impacting availability. But DTC businesses have to get the basics right. That extends to customer service that, when done poorly, can be a core reason for churn (a single error can be annoying, but generally poor response times can be fatal for retention). They must be careful not to focus on cost cutting at the expense of customer service.

Nor should DTC businesses underestimate consumer expectations on social media. They need to remember that it’s not just about delivering content to their community; it’s about answering questions from customers and prospects alike. The personalization of feedback, the tone and response times are all key here. Customers are looking for answers in hours, not days, which reinforces the need for internal teams to work together, not in silos, so as to be present at every stage of the customer journey. A good example of this is Daily Harvest, which has seen a positive impact on LTV after investing heavily in its “care team,” whose members are trained to treat every customer as an individual.

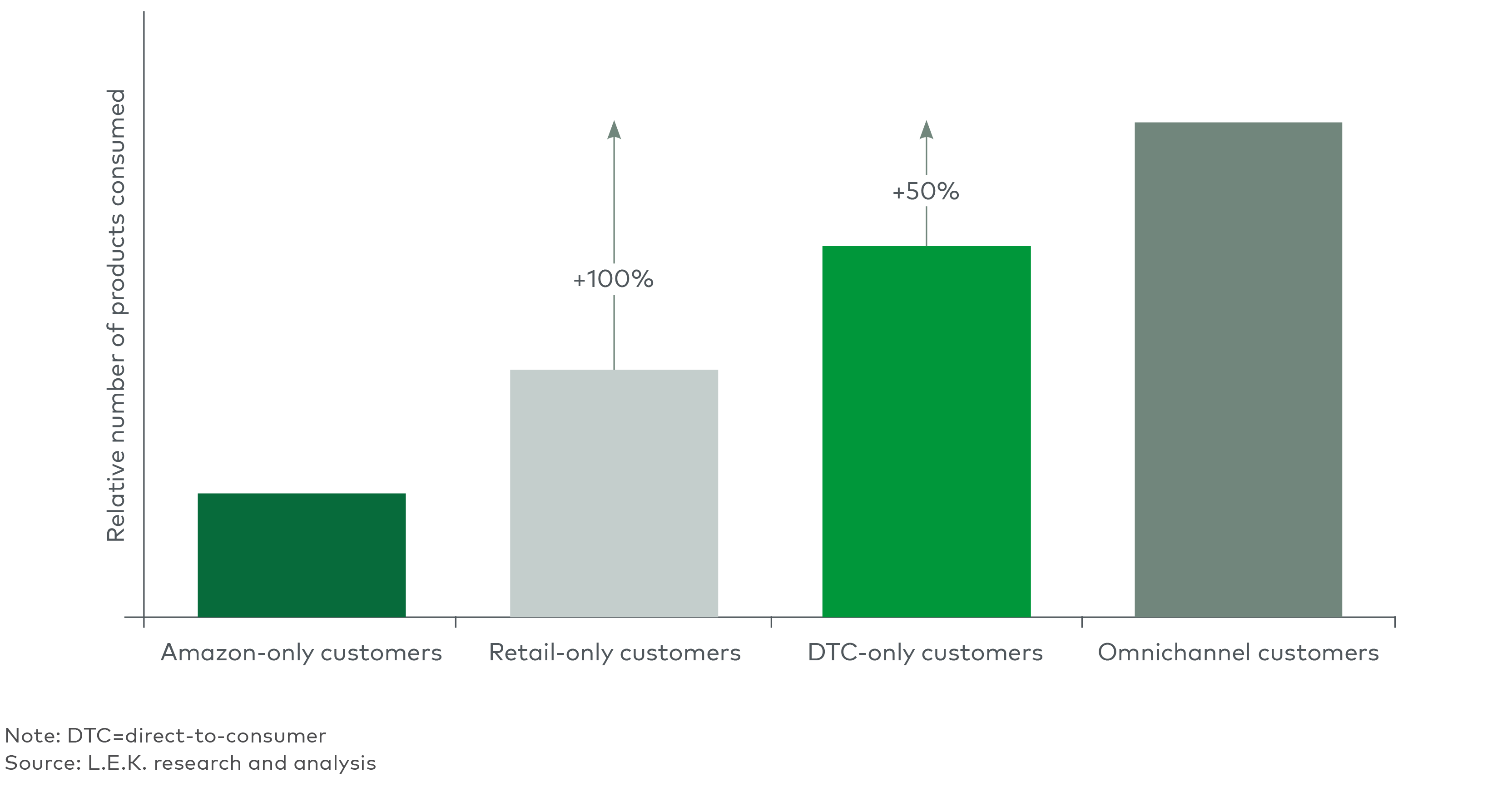

7. Product innovation/limited releases: By giving consumers more reasons to return to buy, product innovation can drive LTV through increased order values and greater stickiness. Expanding product range not only creates excitement through fresh new offerings but can also help build out a complementary system of goods as customers are shopping to solve a need, not just buy a product (see Figure 3). For example, Curology went from selling personalized acne-fighting products to selling an entire acne-fighting regimen (by adding face wash, moisturizer, etc.) that could be bundled but also drove more reasons for a consumer to get hooked on the brand. Another example is Brightland, which added vinegars and honey to its core oil offering in response to customer requests. Meal kit providers, realizing that customers don’t always have time to cook, have also made inroads here recently. For example, Blue Apron and others have added pre-prepared microwaveable meals to give the option of quicker prep times, removing a core reason that customers give up their subscriptions.