Eye on the trend

Given the durability, low maintenance, lifetime value and aesthetic benefits of synthetic materials, a continued shift toward synthetic solutions can be expected. Indeed, in some cases it has already begun:

-

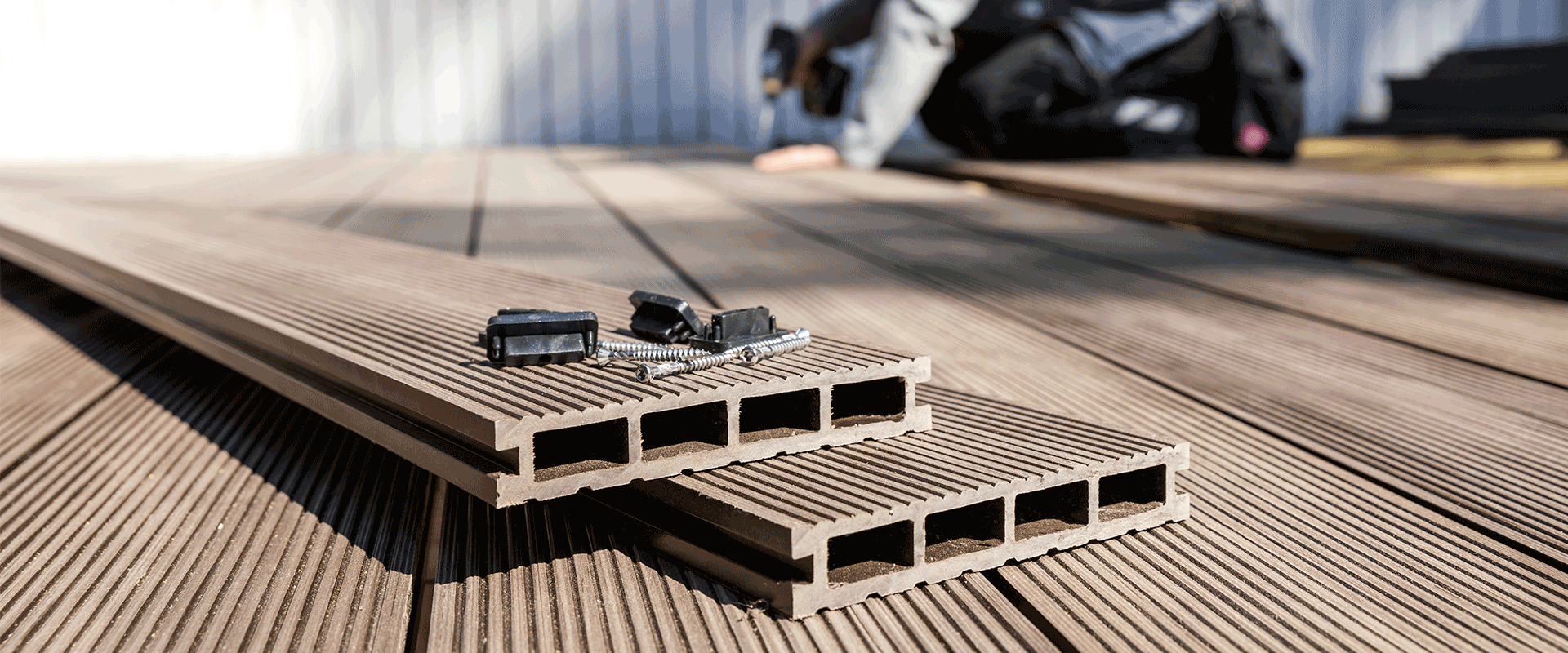

Composite wood grew from 16% of U.S. decking market volume in 2014 to 20.5% in 2020

-

Fiber cement’s overall share of new U.S. single-family home siding volume rose from 15% in 2011 to 21% in 2020

-

Plastic lumber’s share of outdoor living materials in the U.S. increased from 11% in 2015 to 14% in 2020

-

Similar trends have been seen across other categories like flooring, countertops, trim, roofing and more

But share gain is only part of the story. Perhaps the most exciting part is that the companies bringing these products to market are scaled leaders and innovators that enjoy higher margins than their traditional-products peers. In many cases, we believe these margins will be sustainable due to scale benefits and high barriers to entry.

Given the benefits of these products, despite the higher upfront cost, we believe the trend toward engineered products is likely to continue and that it will create opportunities across a range of end markets (e.g., residential, commercial and infrastructure construction) and product categories. Therefore, it benefits players in current end markets and adjacencies to take a close look at what leaders in engineered solutions are doing to gain share and develop sustainable competitive advantages in their markets.

Likewise, for financial and strategic buyers looking to gain a foothold in these markets through acquisition, investing in synthetic base material companies can be a winning strategy.