Fast-Moving EV Battery Market: How to Win Against the Competition?

- VOLUME XX, ISSUE 40

- Executive Insights

The global trend toward electric vehicles is taking place in China’s auto industry. Strong policy support and continual technical advances are the key drivers. For example, the U.S. government incentivizes EV purchases by providing a tax credit of up to $7,500. China has also set ambitious targets and introduced subsidy policies for new-energy vehicles, making China the world’s fastest-growing EV market.

The prospect of continued rapid growth in EV sales is beyond doubt. However, with changing subsidy policies and maturity of the market, competition will become increasingly intense. The American government is considering cutting the tax credit mentioned above, and that will have a significant impact on the EV market. In China, data shows that China’s overall subsidy on new energy vehicles in 2017 has dropped by 40% as compared with 2016, although EVs with high energy density and long battery life continue to receive support from the government. China will stop subsidizing pure EVs with battery life below 150 km but increase subsidies for models with longer battery life.

Under the policy changes, the fast-growing EV battery market is facing increasing challenges. Entry barriers are becoming higher and the market is consolidating. The number of EV battery manufacturers in China dropped from about 150 in 2016 to fewer than 100 in 2017.

So, what are the key success factors?

NiCoMn/ NiCoAl (NCM/NCA) batteries enjoy advantages in energy density and are catching up in cost.

Energy density: In China, policy guidelines require that the energy density of a passenger vehicle battery needs to reach 300Wh/kg by 2020 and 500Wh/kg by 2030. NCM/NCA batteries will be the only ones that can achieve this level of energy density.

Manufacturing cost: Increasing battery production brings economy of scale, with the cost of NCM/NCA batteries estimated to further decline over the next few years. Although the recent rise in the price of cobalt is a factor, it’s still highly possible that NCM/NCA batteries will break the threshold of 1,000 RMB/Kwh in two years.

Safety and service life: Both the safety and the service life of NCM/NCA batteries will be further improved with technical advances, such as better battery management and cooling systems. The number of full charging cycles for this type of battery will reach 1,200 (nearly a 15-year life) by 2020.

We project that global market demand for NCM/NCA batteries will increase rapidly.

In addition to NCM/NCA, a series of new technologies are emerging that will shape the market in the long run. For example, lithium-ion with solid electrolyte can greatly improve safety and energy density. The energy density of lithium-ion batteries with solid electrolyte can be 2.5 times greater than that of liquid electrolyte. Meanwhile, with the absence of liquid electrolyte, storage becomes easier, and additional cooling systems or electronic controls are not required, significantly enhancing safety.

Toyota announced significant progress in solid electrolyte battery research at the end of 2017 and plans to begin shipping cars with solid-state batteries in 2022. In China, several companies and research institutes have also begun research on solid electrolyte batteries. Contemporary Amperex Technology Co. Limited (CATL) and China Aviation Lithium Battery Co. (CALB) have announced that they are both accelerating the development and commercialization of solid-state batteries.

Lithium-ion batteries with solid electrolyte still have problems such as high manufacturing costs, insufficient solid interface stability and low electrolyte conductivity, although these problems will gradually be solved. We believe that early commercialization of solid-state batteries might occur by 2022, with gradual achievement of scale industrialization by 2025-2030.

Manufacturing capacity for EV lithium-ion batteries will expand rapidly to reach 180GWh globally by 2020. China will be the fastest-growing country in terms of capacity, with an estimated 60%-65% of share by 2020, surpassing that of the United States.

Low capacity and disadvantages in economy of scale will be the major challenges faced by small to midsize manufacturers.

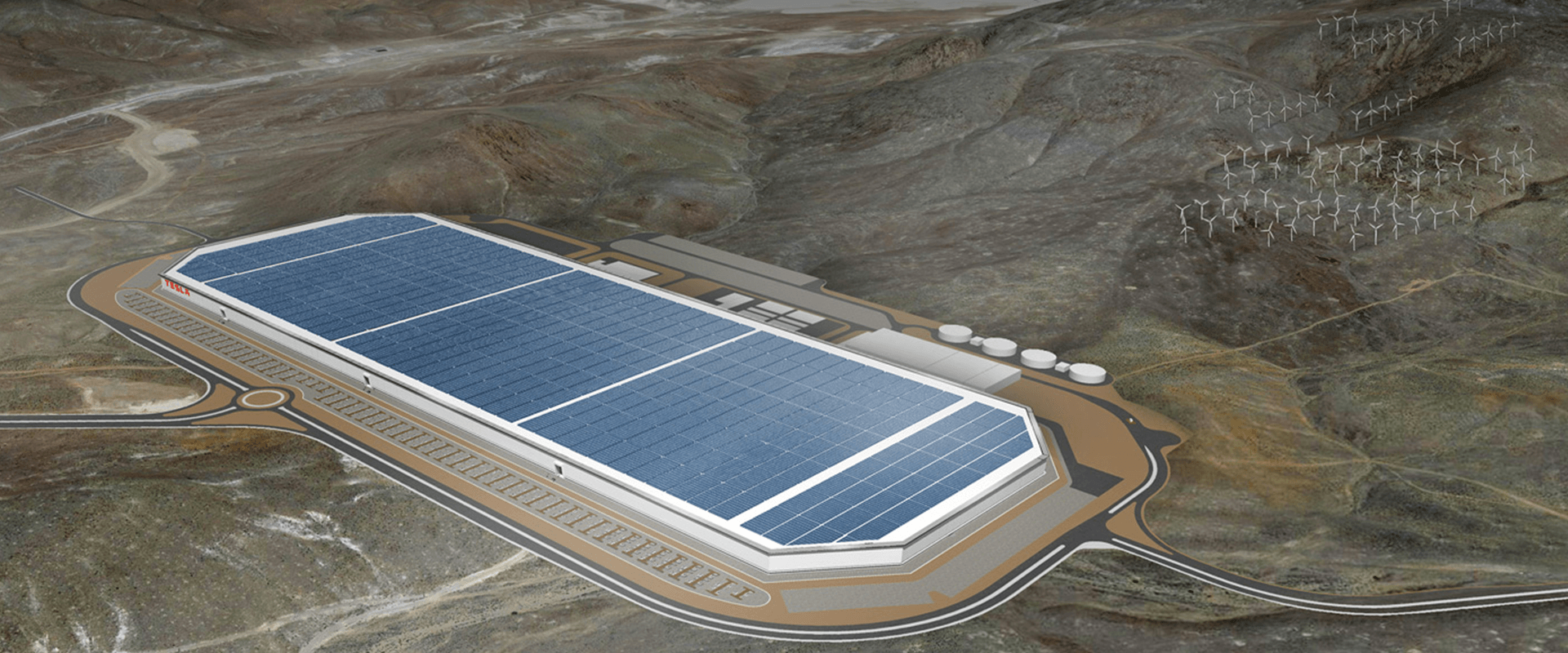

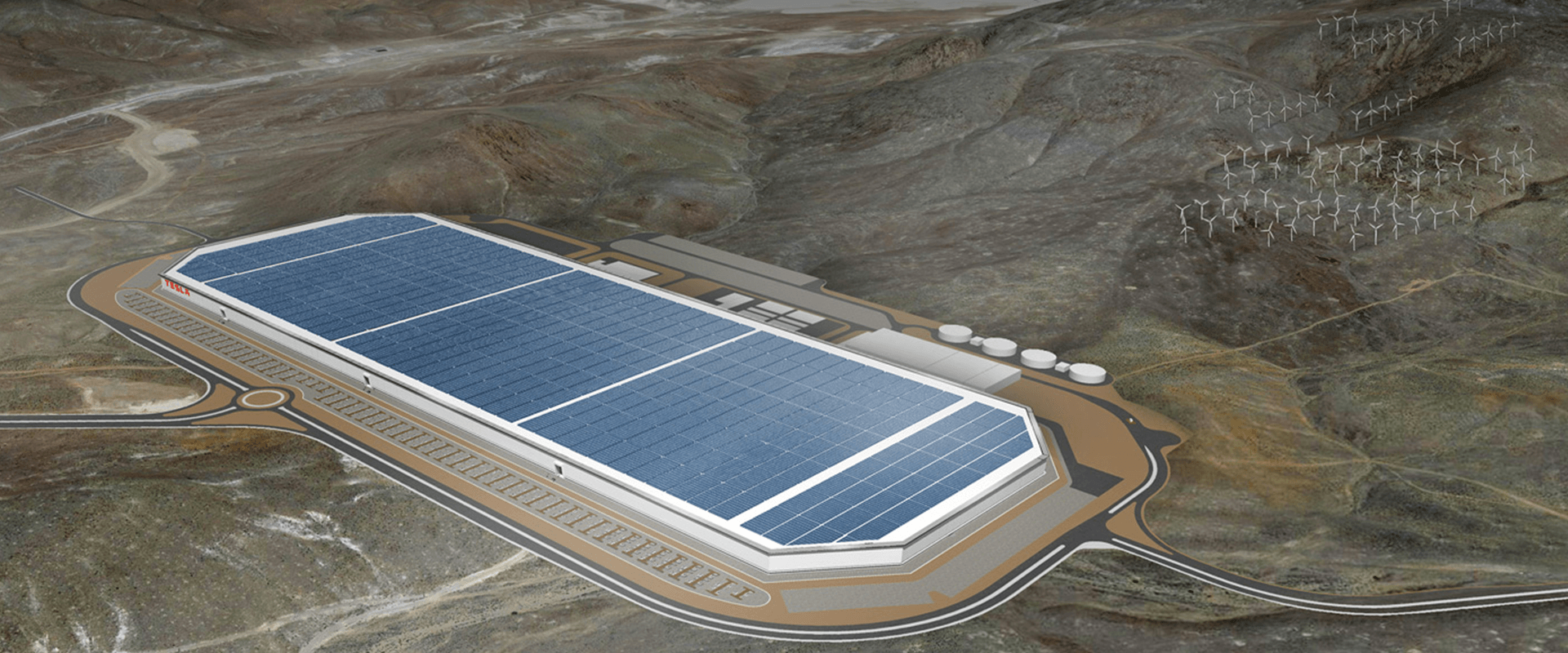

Cuts in subsidies and pressure from downstream OEMs will squeeze the profit margin of battery manufacturers. Companies need to expand capacity to gain an edge on capacity and cost in order to survive. “Megafactories” with 20GWh capacity will bring significant competitive advantages.

Capacity expansion results in a reduction in manufacturing costs. Tesla claims that its newly built megafactory will lead to a 30% drop in battery cost. CATL achieved a 15% decrease in battery cost in the past two years through technology upgrades and capacity expansion.

Rapid expansion of capacity will bring about financial risks. Therefore, strategic partnerships with downstream OEMs are vital to risk reduction. The $5 billion joint venture between Panasonic and Tesla is the most well-known example of how EV battery manufacturers cooperate with OEMs to deal with competition and risks. Similarly in China, SAIC and DF Motor invested in CATL, and BYD announced cooperation with Guoxuan High-Tech. These are all considered to be forward-looking strategies.

EV battery manufacturers (and some EV manufacturers) consider vertical integration as key to lowering costs, extracting more value through synergies both upstream and downstream, and avoiding commodity price/supply fluctuations.

Given the growth in battery sales, demand for raw materials will increase rapidly, especially for nonferrous metals such as lithium, nickel and cobalt. Steady cobalt and nickel supplies are of critical importance.

Lithium battery manufacturers can invest in the upstream and strengthen control of raw material supply. With the increase in cobalt prices, competition between tech companies and EV battery manufacturers/OEMs for cobalt resources has intensified. Apple is negotiating on the long-term purchase of metallic cobalt from mining companies, seeking five-year or even longer stable contracts. Tesla and BMW have announced negotiations with mining companies to ensure raw material supply. In China, CATL and BYD have strengthened their supply chain and control of upstream battery materials in 2017.

Further promotion of NCM/NCA batteries will drive demand for raw materials even while new capacity is limited in the short run. The market is concerned that prices of raw materials will soar over the next three to five years. However, with increases in capacity or emergence of substitute materials, we project that pricing will become stable within two to three years.

Take the case of cobalt for analysis. Increase in capacity of existing projects and the launch of new cobalt mine projects (there are approximately 400 active cobalt mine projects in the world) will gradually increase overall capacity. Hence, we project that the price of cobalt will stabilize after 2019 unless affected by special factors (such as political instability in Republic of Congo, the main supplier of cobalt).

Cathodes account for the highest proportion of cost in battery production, reaching approximately 30% of the total cost.

In China, most components, except separators, have been supplied by local manufacturers. Strengthening R&D-driven investment should be the priority for future development.

It’s important for EV battery manufacturers to strengthen control of the value chain, push proper vertical integration, and control key upstream resources or technologies. Vertical integration is the trend, but associated risks need to be mitigated, including financial pressure, policy uncertainty and upstream material price fluctuations.

We are witnessing great changes in the EV and battery industries. To survive and thrive in this dynamic market, all players must consider carefully how to follow technology development, leverage economy of scale through capacity and capture more value through appropriate vertical integration.