After prioritizing the business units or products, the next step is to define the best aftermarket model — in other words, what is the offering and how will the organization deliver it?

This is a major undertaking. It involves developing an aftermarket concept and refining it incrementally as stakeholders weigh in. Stakeholders include key internal decision-makers as well as channel partners, end customers and third-party service partners.

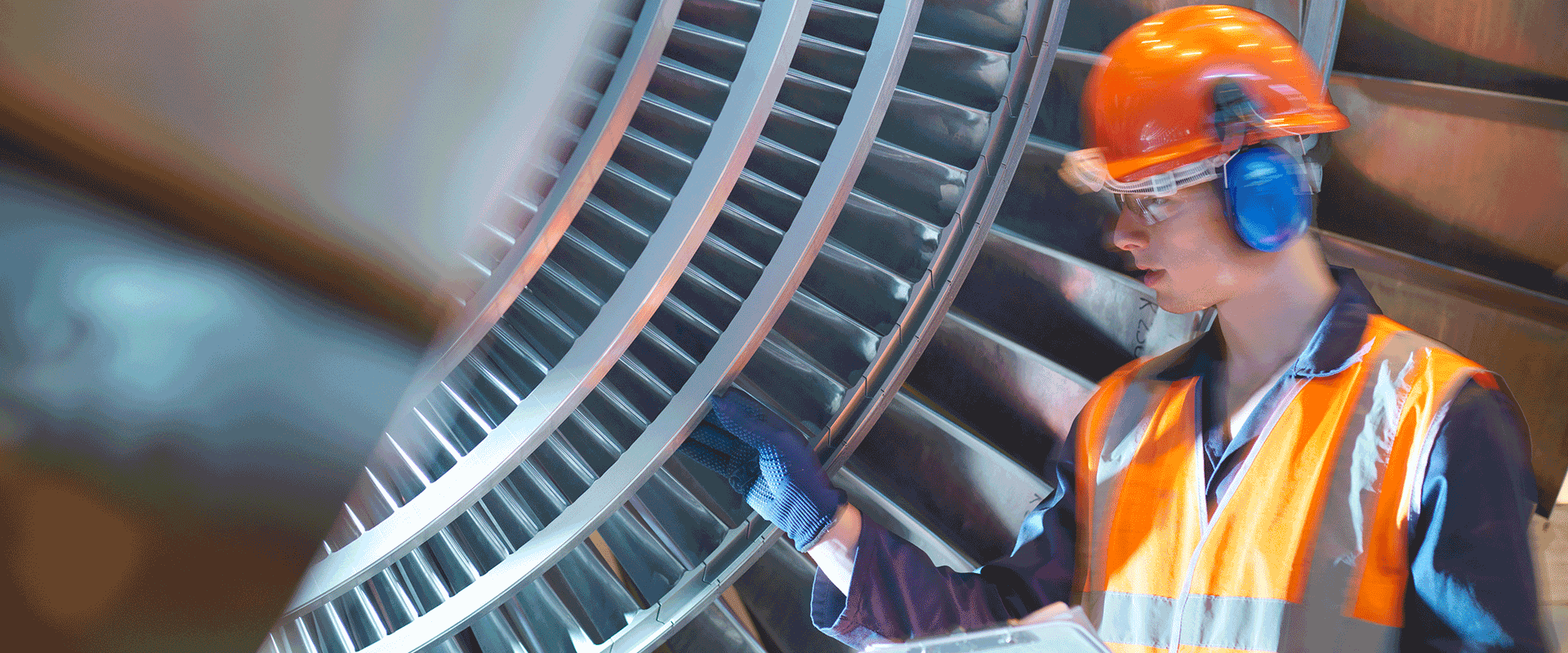

For most manufacturers, the most critical decision is whether to offer aftermarket services (e.g., maintenance, inspection, repair) in addition to replacement units and parts for repairs. Aftermarket services can produce highly profitable recurring revenue. They enable stickier customer relationships and can provide valuable user data for R&D and product development.

But service operations are typically decentralized, especially if the services are time sensitive (such as emergency repairs). They are also difficult to scale and require new capabilities and resources that may have few operational synergies with existing manufacturing assets. Keep in mind, too, that offering aftermarket services directly to end users almost always risks conflict with OEM channel partners.

-

In a direct model, the OEM provides parts and/or services directly to end users

-

In an indirect (“servicing the servicer”) model, parts and/or services are delivered through existing channel and service partners that can add their expertise, capabilities and resources (e.g., preventive maintenance alerts triggered by networked equipment)

-

In a hybrid model, different offerings or services to different customer segments can be delivered through a direct or indirect approach

There’s no one-size-fits-all approach. Each of these models has its pros and cons, as Table 1 shows. The right model will depend on the organization’s current capabilities, market dynamics and the potential for channel conflict, among other factors.