Discover

Social media platforms have become an attractive set of channels for brands like Neutrogena and ColourPop. They’re reaching out on Instagram, TikTok and other platforms to introduce new products and remain top of mind, using content carefully aligned with the interests of their target audience. A recent example is e.l.f. Cosmetics’ “Eyes Lips Face.” Launching shortly after TikTok’s U.S. introduction, the campaign prompted thousands of influencers and followers to create their own versions of the makeup brand’s 15-second commercial spot.

Some companies are going beyond digital content marketing, inviting discovery through personalized BPC product recommendations that are likely to resonate with consumers. Curology’s brand platform matches patients with licensed clinicians who assess their needs online, then prescribe a custom skincare treatment. Meanwhile, Boots and Ulta are among the retailers that are making Revieve’s Digital Beauty Advisor personalization engine available to their customers. The service uses AI to analyze trouble spots like dark circles, skin texture and melasma to produce customized recommendations.

Trial

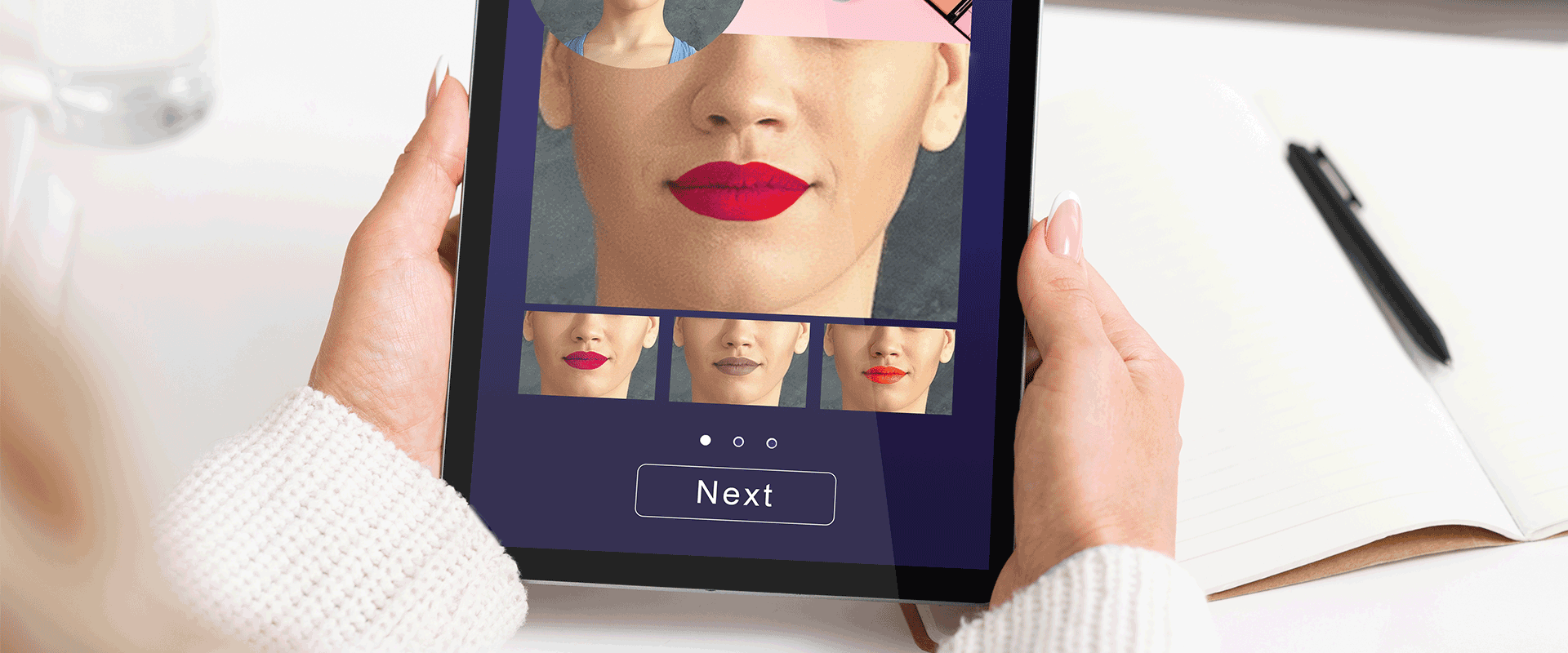

Once a prestige offering, virtual try-on tools have now gone mainstream, boosted by advances in AR. These solutions give shoppers a way to see how color cosmetics will look on them without the sanitation concerns of store testers. Consumers can upload a photo, use a live webcam or select a model with similar coloring to try on different shades. Perfect Corp. and L’Oreal-owned Modiface are just two of the companies bringing emerging technologies to bear in re-creating in-store experiences for the digital world.

Besides empowering customers to select their own products, some BPC brands and retailers use AR and AI to provide personalized product matching, suggesting products based on complementary colors, shades and need segments. For instance, Madison Reed’s ecommerce site suggests extras like hair masks and root concealers to coordinate with shoppers’ hair color selections. At MAC Cosmetics, shoppers can compare lip and eye colors to see how products look on different skin tones.

Purchase

The rise of omnichannel experiences, which the COVID-19 crisis accelerated, is a reflection of consumers’ growing expectation of a consistent shopping experience regardless of channel. But touchpoints — think mobile, in-store and curbside pickup — are continuing to multiply as beauty consumers shift more of their purchasing online. In response, retailers and brands are looking to technology as a way to take friction out of the customer journey.

One development is the introduction of “phygital” — that is, solutions with aspects of both the physical and digital realms. At Estee Lauder counters, for instance, store consultants can use the brand’s iMatch Skincare Finder to surface hidden skin damage and determine ways to address it. Pre-pandemic, at digital-first Glossier’s retail locations, shoppers entered a clublike atmosphere where they were encouraged to sample the products as they mingled at communal tables, consulted with “editors” and paused for selfies.

Another way to prompt a purchase is by offering products that are made to order. Using natural and organic ingredients, personalized beauty brand Untamed Humans generates skincare formulas based on age, skin type, climate and other customer criteria. Yves Saint Laurent recently introduced a handheld device called Beauté Rouge Sur Mesure Powered by Perso that uses color pods and learning algorithms to mix custom lip colors.

Apply

How-to content is gaining traction among beauty customers, who may be inclined to buy more if they’re more confident in how to use the products. To extend their reach, beauty companies are exploring partnerships with digital media and platforms. Fenty Beauty, Rihanna’s cosmetics brand, set up a TikTok page featuring influencers in quick-take product demos. Meanwhile, Bumble and Bumble teamed with digital media company Coveteur to produce a series of storylike tutorials on solving hair challenges with Bumble’s products.

Smart devices take how-to a step further by taking some of the work out of makeup application. The Opte device from P&G Ventures — Procter & Gamble’s in-house business incubator — uses a digital camera to find skin discolorations, then applies a serum to cover and fade them.

Then there are filters that allow consumers to skip makeup application altogether. Digital makeup apps like Perfect365 allow users to retouch their photos and try on virtual looks designed by professional makeup artists. For live meetings, Zoom’s “Touch Up My Appearance” feature uses a soft-focus display to enhance the user’s appearance. And in what feels like the videoconferencing era taken to its logical conclusion, Zoom users can use Snap Camera’s beauty filters to put their best face forward, even when that face is bare in reality.

Engage

A chief drawback of traditional text and chat messaging is the inability to detect the emotional state of those you’re communicating with. Tone Analyzer from IBM Watson aims to remedy that by infusing chatbots and social listening tools with AI that can detect how people are feeling so companies can personalize their customer service experience. AI can also analyze large volumes of customer feedback to inform product development, which is what Avon did with its Genius Algorithm. The results led to the debut of the brand’s True 5-in-1 Lash Genius mascara.

Replenish

Ecommerce auto-replenishment and autoship solutions offer consumers convenience and (often) discounts while helping brands and retailers stay ahead of demand. Sally Beauty, QVC and BareMinerals are just some of the players taking advantage of these technologies to enable automatic reorders for their customers.

Technology by way of gamification has also had a hand in the growing sophistication of loyalty programs. Roulette wheels, scratch-offs and other digital novelties can drive greater customer awareness, engagement and lifetime loyalty. They can also encourage customers to make use of their loyalty points and try different items in the company’s product lines. Lancome took gamification to the next level by working with Alibaba to produce an AR scavenger hunt in which consumers could win the beauty brand’s products. MAC, for its part, brought gamification into the real world when it teamed up with Tencent to create makeup sets associated with characters from the Chinese company’s Honor of Kings game.