Background and challenge

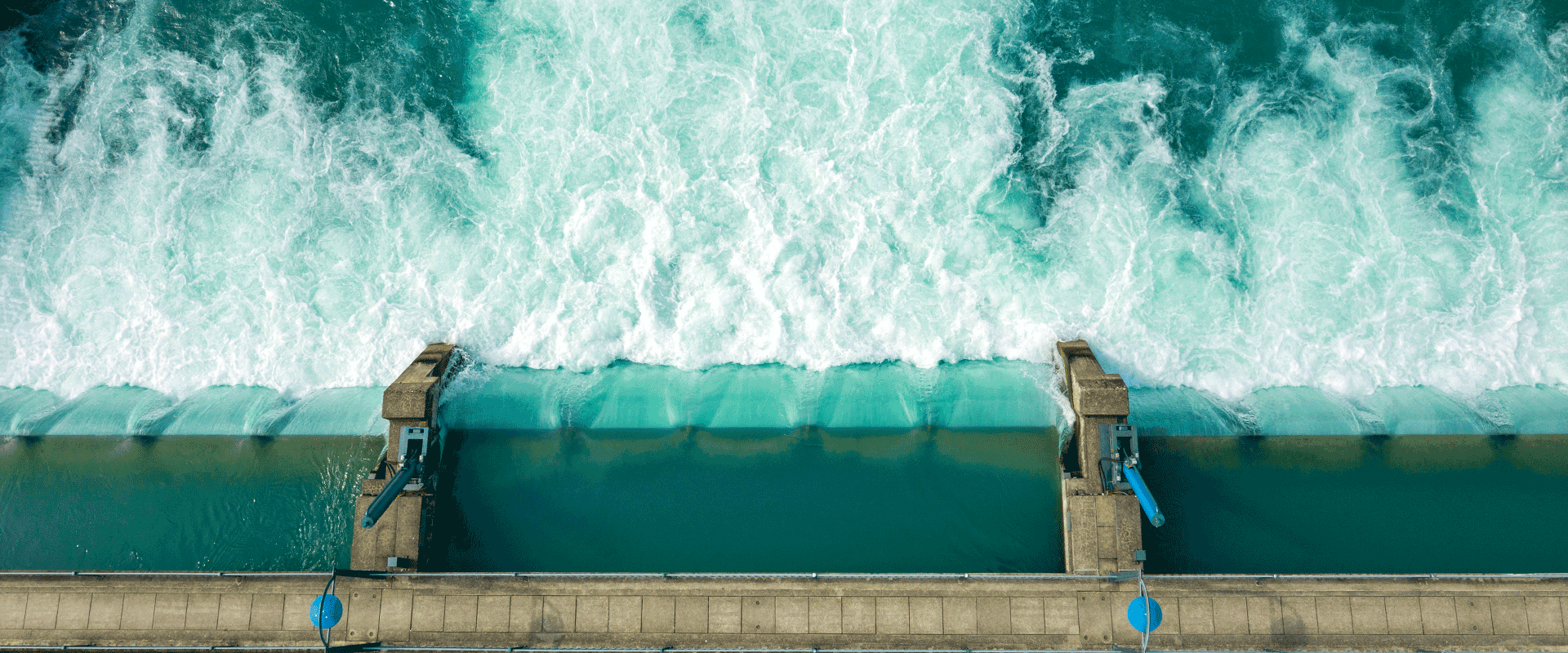

A leading global industrial conglomerate was investigating an opportunity to invest around $2 billion in the water treatment market. The company already had some exposure to the upstream value chain of the market and was looking to reinforce its presence in the market overall — possibly via a move further downstream.

Approach and recommendations

L.E.K. Consulting investigated growth opportunities across the entire water treatment value chain and conducted due diligence on several businesses that the company had identified as priorities. Specifically, we determined market size and growth prospects, competitive intensity, profitability, capex intensity, cyclicality, and overall attractiveness for the following segments:

- Raw materials

- Components (membranes, sensors and commodities)

- Modules (higher tech content and commoditized)

- Project/system integration (exploration and production; engineering, procurement and construction)

- Service (conventional, build-own-operate/build-own-transfer and mobile)

In addition, we looked at multiple water treatment end-markets, including municipal, pharmaceuticals, microelectronics, food and beverage, oil and gas, power, and mining.

Results

We determined that the company had the opportunity to reinforce its position in the upstream portion of the water treatment value chain, as well as to develop a presence in certain higher-value market segments downstream. Following the project, the client rolled out its M&A strategy and completed several acquisitions in the water treatment market based on our recommendations.

01022024150141