To understand where the OCE market is headed, it helps to see how brands and retailers are putting solutions together. Let’s look at a few examples.

Mucinex

2020 was the breakout year for TikTok, a social media app focused on short-format video content. TikTok lets users add their unique perspectives to a theme free of onerous content rules. That proved an effective platform for #BeatTheZombieFunk, a challenge from Mucinex that encouraged consumers to watch a dance tutorial and record their own takes for the chance to win cash prizes and VIP experiences.

Mattress Firm

In February 2021, Mattress Firm introduced a digital tool to help consumers determine the best mattress for their needs. Developed in conjunction with SleepScore Labs, a sleep science company with data points from more than 70 million hours of observations, the tool takes consumers through a brief quiz and delivers product recommendations that address specific needs. The two organizations have announced plans to follow up with an app that consumers can use to track their sleeping experience.

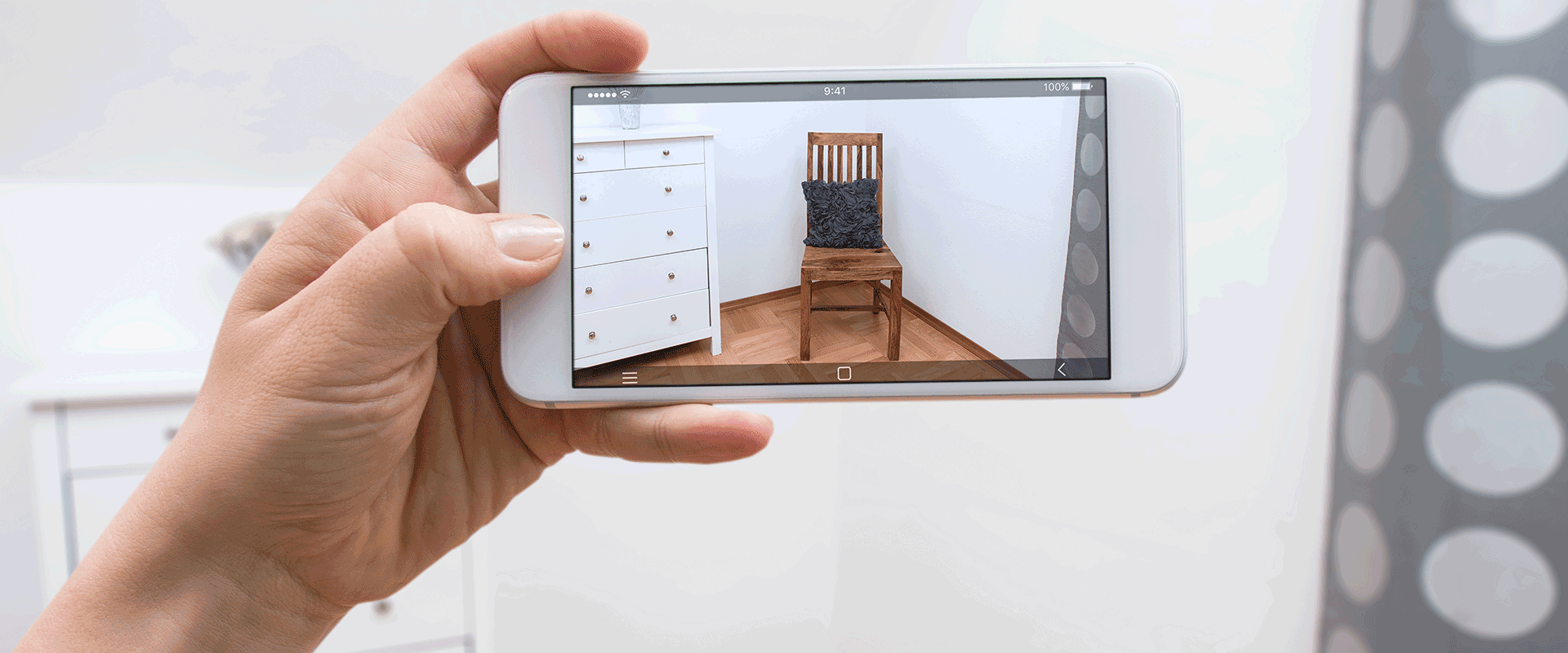

Benefit Cosmetics

Brow Try-On by Benefit Cosmetics is an AR-powered app the company launched in January 2018. The app gives shoppers the chance to see how different eyebrow shapes, widths and colors would look on them. Then, once the consumer chooses a look, the app offers two ways to achieve it: Book an appointment at one of Benefit’s in-store BrowBars or purchase the suggested products to recreate the look at home.

Whole Foods

At Whole Foods, conversational marketing — a consumer retention technique that primarily relies on chatbots — is gaining traction. The grocer also has a Facebook Messenger-based bot that can respond to messages as short as a single emoji. The tool connects with consumers by providing recipes, products and cooking inspiration.