The Future of Retail: Get Ready for the Revolution

- VOLUME XX, ISSUE 1

- Executive Insights

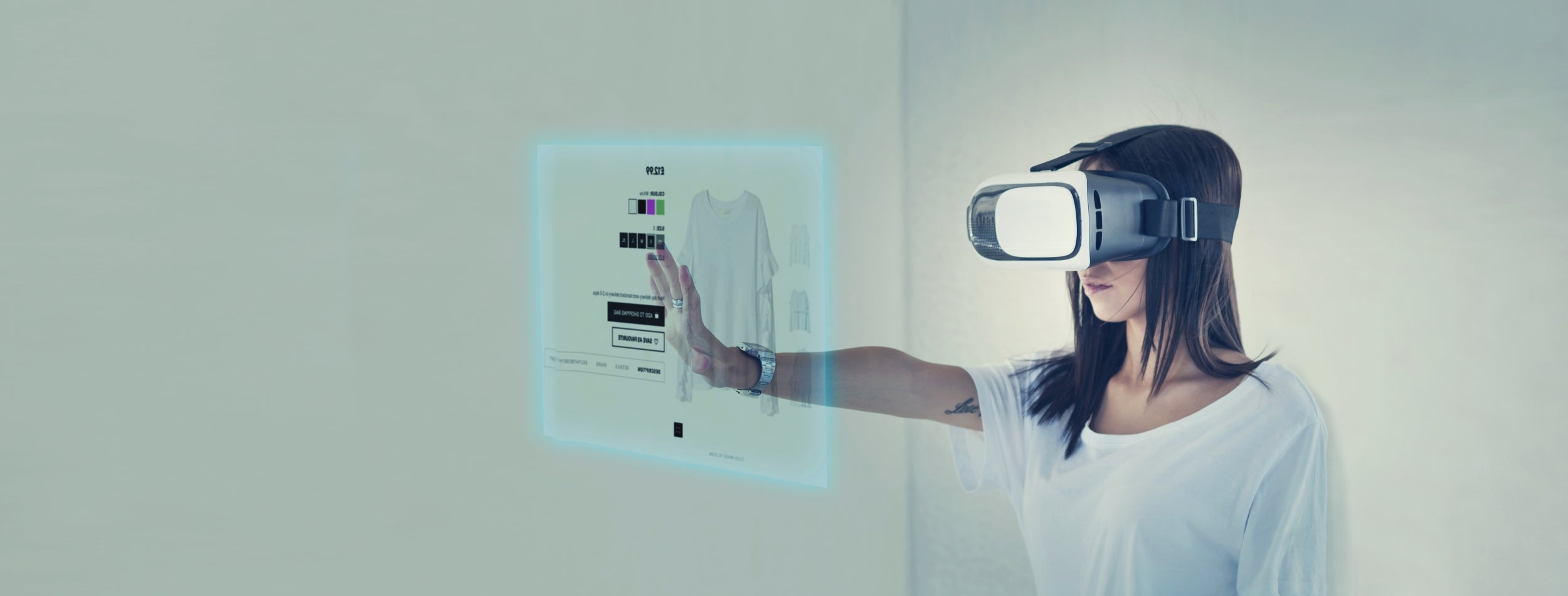

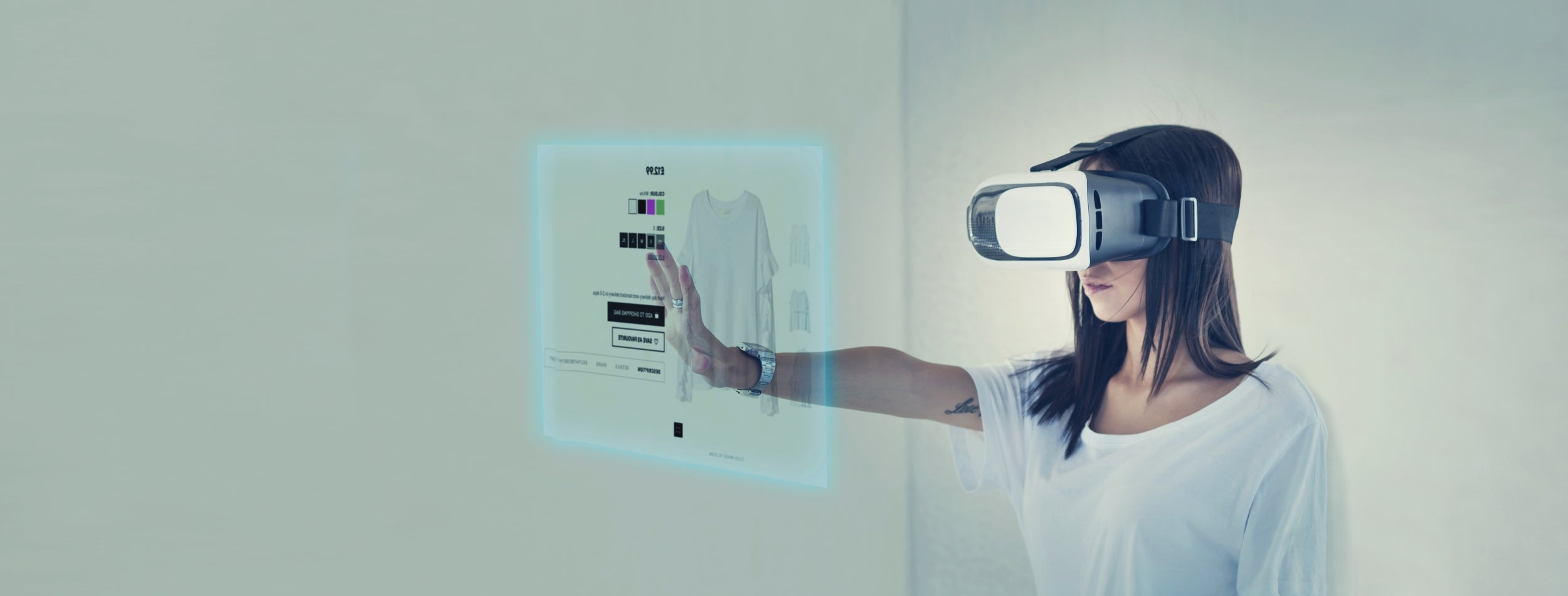

Technology is transforming the retail sector. Developments in the pipeline in artificial intelligence (AI), virtual reality (VR) and innovative delivery systems will by 2030 enable dramatic changes in consumer behavior, challenging the economics of many retail business models and rendering some obsolete.

If retailers are to avoid being left behind, they must act now. At present, most view their businesses through the lens of a three-to-five-year strategic planning cycle, preparing predominantly only for the next wave of incremental change within that period. The deceptively slow penetration of digital retail to date, and its uneven impact across the sector, have created a false sense of security. Yet while planning in the medium term, retailers are also making longer-term commitments to retail store networks and format concepts that may prove unsuited to the future of shopping.

In this paper, we explore the technological advances that are changing the retail sector and their likely impact. We look at the prospects for existing business models and set out the questions that retailers must address to prepare for the future.

Many retailers have been slow to introduce digital technology. While online shopping channels such as Amazon have sprung up on the back of the internet and mobile technology revolution of the past two decades, brick-and-mortar retailers have tended to offer digital to supplement existing physical distribution channels rather than to replace them. In part, this generally limited development has been a result of two landmark economic events: in the 2000s, after the dotcom boom and bust, many physical retailers chose to focus on driving in-store sales; and since the recession hit after 2008, they have been forced to cut prices in an attempt to draw customers to stores through a prolonged period of weak consumer expenditure. Cash for transformational investment has often been in very limited supply.

The lack of investment in digital infrastructure is likely to have serious consequences in the long term. Canadian sci-fi writer William Gibson says, “The future is already here — it’s just not evenly distributed.” This is true of digital retail. Digital retail is already important in electronics and appliances, accounting for almost a fifth (19.5%) of U.S. sales in 2017, according to U.S. Census Bureau data. By contrast, all other major categories are below 10%, including clothing (9.5%), furniture (6.4%) and general merchandise (3.3%). Digital also has only moderate impact overall, accounting for 14.8% of retail spend in the U.S. and 16.8% in the U.K. in 2016. Consequently, a fundamental rethink of business models has seemed unnecessary to many retailers.

However, technological developments will soon make both the experience and economics of online shopping attractive to consumers for a much greater number of categories. This will drive acceleration in the rate of digital adoption, reinforce the scale advantages that the leading ecommerce marketplaces already command, and amplify the significant challenges for businesses across the entire retail sector.

We expect two important changes to boost adoption of online shopping over the next few years. Their combined effect will become so compelling that customers will be able to shop without ever needing to set foot in a physical store.

This combination of faster communication, AI, VR and new delivery systems will create a tipping point for retailers, boosting digital sales, changing the role of physical stores and forcing a fundamental rethink of retail value propositions. In this new world, retail is likely to polarize into two winning models.

But physical stores will continue to play an important role in order to engage, educate and entertain consumers and to reinforce emotional connection. The store estate, however, will not require such extensive high street presence as we see today. Shopping may progressively concentrate in hubs that offer clusters of category-specific stores in key locations to coax like-minded shoppers out of their homes and offices with a compelling retail and social experience. In this environment, physical stores will take their place alongside digital purchase and delivery solutions.

The magnitude of these changes will require a fundamental rethink in retailers’ long-term strategies, even in those categories that currently have low levels of digital penetration. In a world where in-store shopping is forecast to fall by 20-30% over the next 10-15 years and gross margins will decline due to increased price transparency, the economics of existing store portfolios simply will not work. Retailers will find themselves with many economically unsustainable stores by the time their leases expire (see Figure 3). They will need to define a new model and a new role for a smaller, more focused store network.

There are four questions that retailers should ask themselves as they build this new model:

Retailers and brands will have to adapt to selling different things in different ways and from a different space. To do this, they will need to better understand why they are relevant to their customers’ lives and work to deliver this. An all-encompassing general offer is likely to disappear — except for the Amazons of this world — replaced by either brilliant curation or an authoritative but focused offer.

The barriers that have prevented digital retail from becoming more prevalent are coming down. The timescales for organizational change are long and typically beyond a board’s traditional three-to-five-year focus. Nevertheless, the technological advances outlined above will see a fundamental shift in the way the retail sector operates over the next decade.

The changes that retailers need to make to combat the threat cannot be made overnight. As a consequence, companies must act now to make a realistic assessment of how they can adapt to survive the future of shopping.

Further reading