CBD: This Cannabis Extract Is Creating a Different Kind of Buzz

- VOLUME XXI, ISSUE 10

- Executive Insights

By removing hemp from the federal list of controlled substances, the farm bill that President Trump signed in December 2018 made hemp-derived CBD legal in all 50 states.

However, regulations have been slow to catch up with a phenomenon that is experiencing accelerating growth and is poised to hit the mainstream.

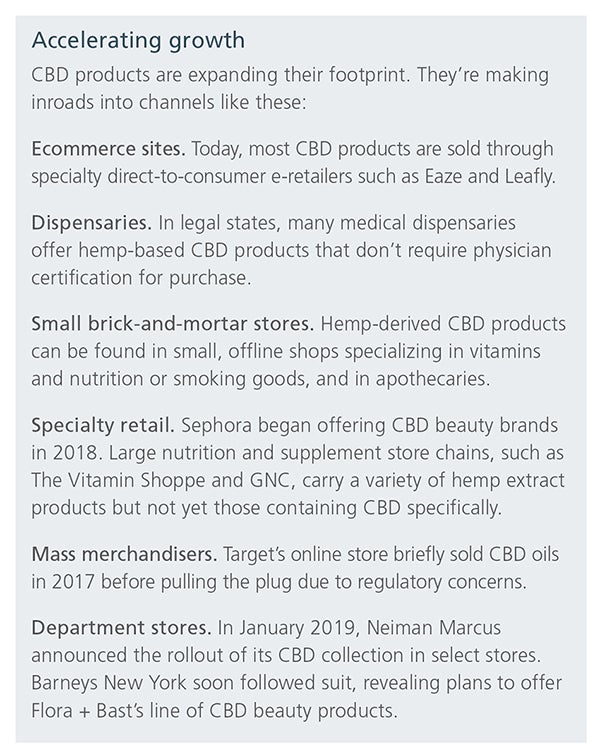

CBD products are expanding their footprint into ecommerce sites, dispensaries, specialty retail, department stores and mass merchandisers, among others.

Manufacturers and investors that are planning a market move should formulate a game plan, including forging relationships with national retailers, arming consumers with information about CBD and proactively creating an Amazon strategy.

The farm bill that President Trump signed in December 2018 renewed a wide range of existing agricultural programs, from price supports to conservation and food aid. But buried in the bill’s 807 pages was something rather less routine. It was a set of provisions that cleared the way for a new cash crop in the U.S.: industrial hemp.

Shortly after the farm bill’s passage, a trio of Wall Street analysts covering a little-known startup called Charlotte’s Web Holdings recommended the company’s stock as a “buy” or “strong buy.”

What does one event have to do with the other? Charlotte’s Web makes wellness products with cannabidiol (CBD) as the active ingredient. The CBD in the products comes from hemp.

CBD is a chemical that reportedly offers relief from anxiety, inflammation and chronic pain, among other therapeutic applications. It’s found in both hemp and marijuana, two different strains of the cannabis plant. But hemp doesn’t contain enough tetrahydrocannabinol (THC) to produce marijuana’s euphoric high, a distinction that has fueled the growing acceptance of hemp as a commodity crop.

By removing hemp from the federal list of controlled substances, the farm bill made hemp-derived CBD legal in all 50 states. Beyond that, the bill made it possible for hemp farmers to obtain credit, crop insurance and other benefits of the government’s agricultural programs.

But raising hemp is one thing; making the CBD from hemp available to consumers is something else altogether. The Food and Drug Administration (FDA) doesn’t allow the interstate sale of CBD in food, beverages and dietary supplements. The agency also has clamped down on companies that made claims about the therapeutic benefits of the CBD in their products or were less than explicit about how much of the derivative the products contained. To support its watchdog position, the FDA points to the recent authorization of Epidiolex, made of highly purified CBD, as a prescription anti-epileptic drug.

Nonetheless, murky regulatory waters have done little to dim consumers’ enthusiasm. Even after the Drug Enforcement Administration (DEA) released a new drug code for marijuana extract in December 2016, raising uncertainty around CBD’s status, public interest in the additive continued to rise. An analysis of social media mentions in recent years reveals the trend (Figure 1).

To avoid FDA run-ins, CBD brands and manufacturers tend to be circumspect about their claims. The result is a confusing melange of products that requires some effort to sort out. In L.E.K. Consulting’s analysis, they appear to break down across four types of benefits:

An examination of 639 products that contain CBD (but not THC) shows they span a range of types, formats and brands (Figure 2).

In the absence of regulatory clarification, CBD-infused consumer products often rely on product type to signal the properties on offer. Although tinctures and dietary supplements are the most common CBD products, beauty is rapidly catching up with a growing portfolio of lotions, balms, bath products and more. Food and beverage producers are also staking their claim, catapulting CBD-infused food and drink to the top of a list of culinary trends for 2019. As though the market weren’t complex enough, products can further vary by flavor, dosage, package size and other attributes.

All this activity is fueling expectations of significant growth. Cannabis research firm Brightfield Group estimates CBD product growth exceeded 80% in 2018 alone. By 2026, according to Transparency Market Research, the global CBD hemp oil market will hit $2.5 billion. Meanwhile, deal-making is also on the rise (Figure 3).

This brings us back to CBD’s regulatory limbo. Many of today’s products are in a gray area of the law. Although neither the FDA nor the DEA has made it a priority to police the commercialization of CBD in food and cosmetics, certain brands have created their own downside by simply winging it in the absence of standards. For example, some CBD-infused products omit an explicit listing of the ingredient on their labels. Others misstate the amount of CBD in their products. Left unchecked, this could foster misgivings among consumers and retailers alike.

So where does this leave manufacturers and investors? Consider the following steps for a CBD game plan:

For a category that didn’t even exist just five years ago, consumer CBD products have become a phenomenon. Now, they’re poised to enter the mainstream. A wait-and-see approach may seem sensible to incumbent firms looking for certainty from the FDA before taking the plunge. But with competitors already crowding the field, the better bet may be to start planning a market move now.