L.E.K. Look Forward Into 2024

Welcome to Look Forward, L.E.K. Consulting’s annual analysis of the challenges and opportunities in the year ahead. In this article, Remy Ossmann from L.E.K.’s Consumer practice examines the investment opportunities presented by branded restaurants in Europe.

Look Forward to branded restaurants on the investment menu

What are the branded restaurant categories and what is their European market share?

Branded, or chain restaurants are on the rise across Europe with both quick service (QSR), and casual dining (CDR) categories experiencing strong growth. Long seen as market leaders in the US where QSR is a particularly high 64% of the market in PoS, US brands have had strong success exporting their concepts internationally, making names like McDonald’s, Burger King and KFC a global phenomenon. In contrast, the PoS penetration rate for branded CDR is still low in many European countries – c.4% in France compared with c.12% in both the US and the UK, and while growth since 2007 has been good in some European countries, the category has run out of steam in the US where it has plateaued at c.13%. It is fair to say that - contrary to QSR - there are no real international CDR brands, as concepts remain anchored in local cuisine (see Figure 1).

Spotlight on France

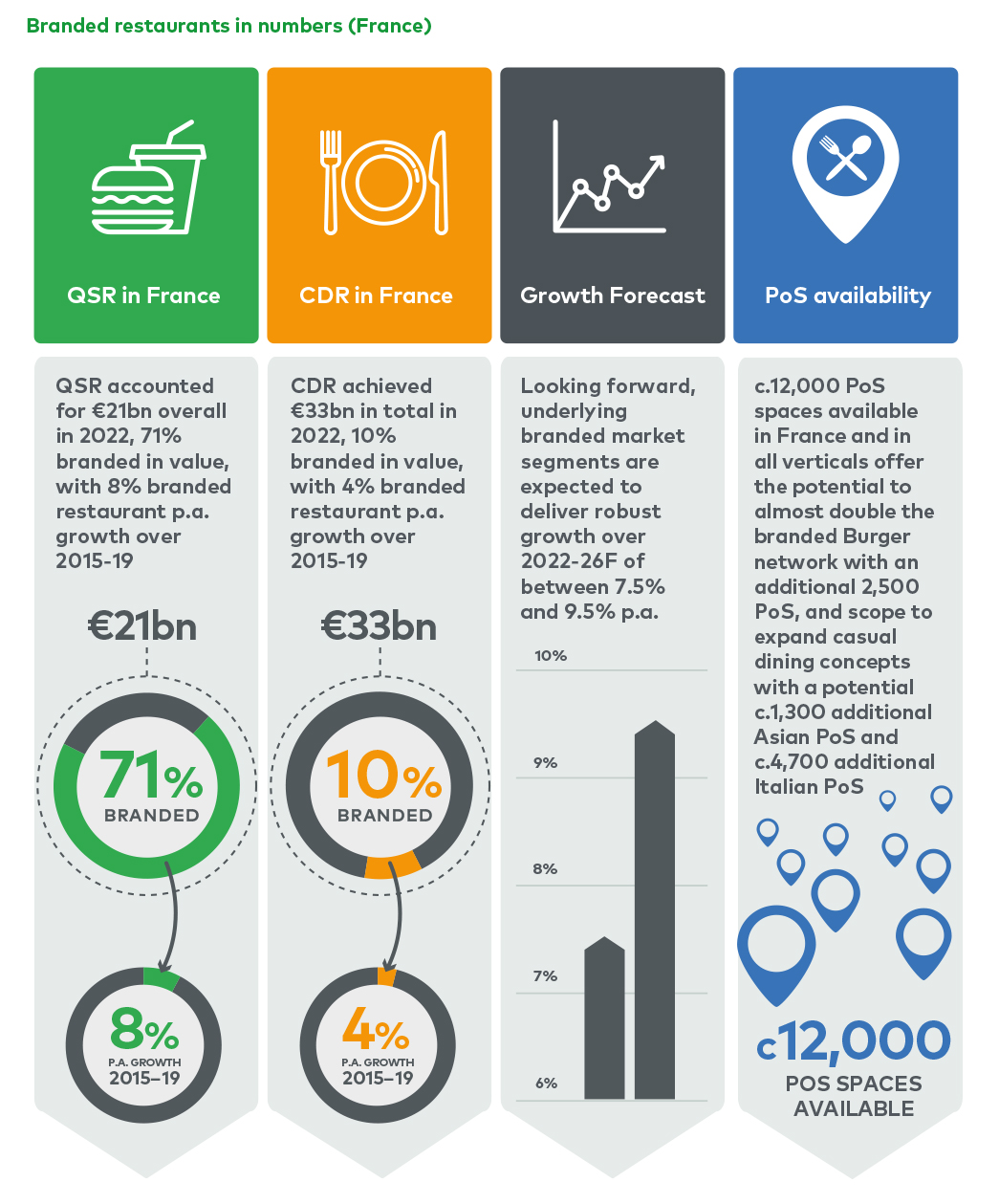

Taking a closer look at the French market helps to create a better understanding of the dynamics at play. The French restaurant market is considerable, worth €54bn in 2022. Positive demand and supply side trends such as consumer time poverty and an increase in out-of-home meals ensured continued growth at a rate of c.5% p.a. in the run up to COVID. Lunch vouchers, new consumption movements, new cuisines, a desire for quality eating and omnichannel development allowing home delivery, click and collect, takeaway and drive- throughs have all played a part in supporting this growth.

Brands have grown even faster, at 7.0% p.a. pre-COVID (2015-19), and branded restaurants in both QSR and CDR categories accounted for c.€19bn of the market in 2022, beating pre- pandemic highs. Convenient and affordable, QSR burger is the leading market segment, with the highest share of brands and franchises backed by strong growth and resilience. Similarly, in the casual dining segment, brands offering concepts such as Italian, Asian, and Grill are steadily gaining share over independent restaurants.

Franchising — the recipe for success?

Branded concepts offer a range of advantages for consumers including affordability, quality, and consistency, while for operators they provide the opportunity to industrialise to drive efficiencies. Even in casual dining, consumer preference for branded propositions is robust, creating significant headroom for expansion and new market entrants. Network growth is helping brands to grow faster than the overall restaurant market with franchising the main enabler. Franchising is attractive to both franchisors and franchisees. For brand owners the efficient, fast rollout, more productive franchising income and capex-light development all help to create strong value. While for entrepreneurial franchisees turnkey concepts with well-known brands generating traffic from day one, coupled with strong operational support and robust economics make for an attractive business proposition.

Within the French franchise market, the restaurant segment for both QSR and CDR was the third largest in value in 2022 (c.€9bn) after the Grocery (c.€28bn) and home equipment categories (c.€9bn). Franchised restaurants have outperformed franchise industry averages, growing at an overall c.7% p.a. in value over 2015-22 vs. 5% for all franchises, and QSR performing particularly strongly at 8% p.a.

How the advantages of brands add up

Brands offer valuable scale – providing not just market leading capabilities such as development, franchising, roll-out, marketing, operations, procurement, market intelligence, information systems and M&A, but also the bargaining power to maintain lower rents, discounted bank loans rates, cheaper F&B and utilities costs, and advantageous terms with delivery partners. The end result is a price competitive advantage that independents struggle to match.

While COVID did cause a short-term decline in the French restaurant market, branded concepts and QSR resisted better than independents and casual dining restaurants. Value for money, adaptability to omnichannel, trusted and consistent products, and better economies of scale have all contributed to this resilience.

Conclusion

Whether investors are attracted to the clear white space for category penetration offered by QSR, or by the gradual displacement of independent CDR restaurants over time, all can look forward to a menu of opportunities across the European branded restaurant sector. Recognising how and when to take advantage of these opportunities can take knowledge and expertise. To hear more about our work in this exciting sector, please contact a member of the team.