The Biggest Opportunities Oil and Gas Executives See in the Energy Transition

L.E.K.'s 2021 Global Energy Transition Study

- Article

L.E.K.'s 2021 Global Energy Transition Study

Here’s the latest in our series of articles on findings from the L.E.K. Consulting 2021 Energy Transition study. Last time, we looked at the kinds of energy transition investments that companies along the oil and gas value chain are making today and are expected to make in the future. What we didn’t discuss was which ones they believe would offer the greatest opportunity for the industry. Let’s touch on that briefly.

In our study, we asked 261 energy executives where they think the biggest energy transition opportunities are for the industry. More specifically, we asked them to rank their top three energy transition developments in order of opportunity potential.

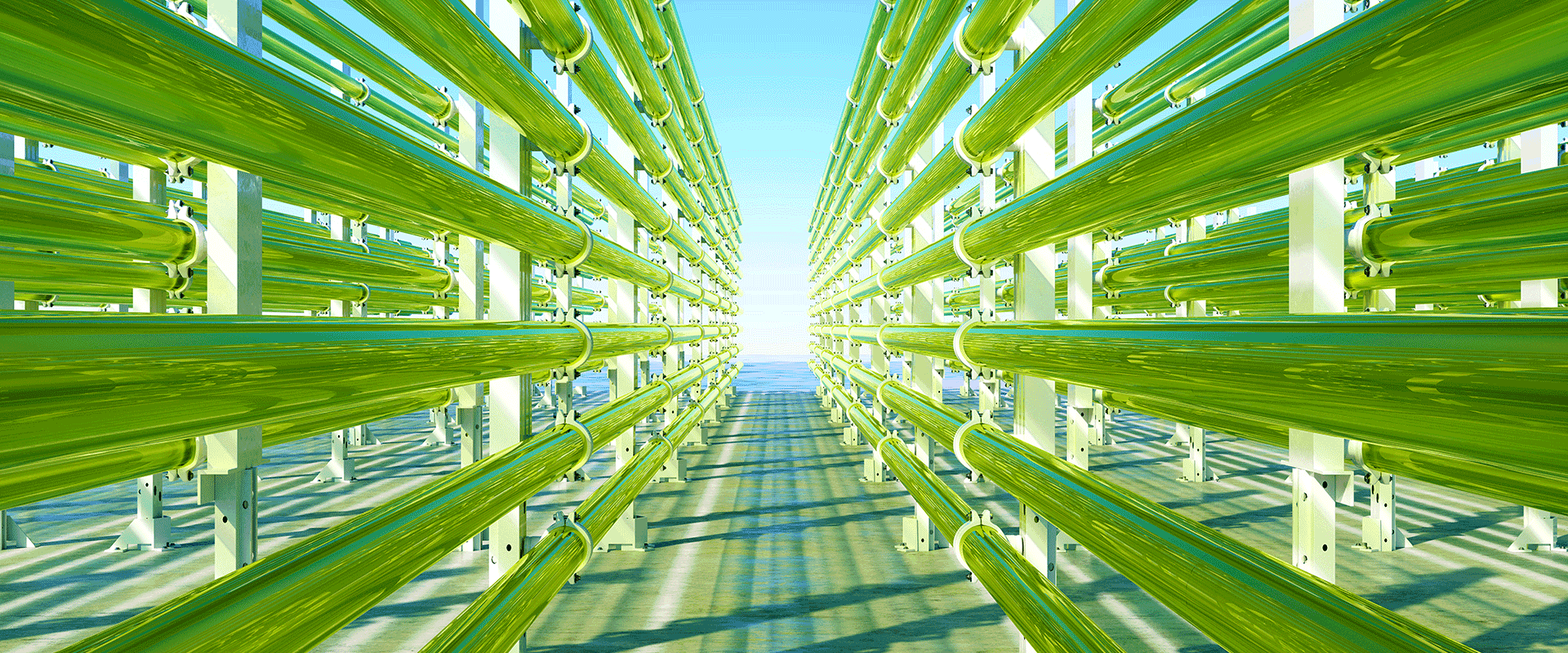

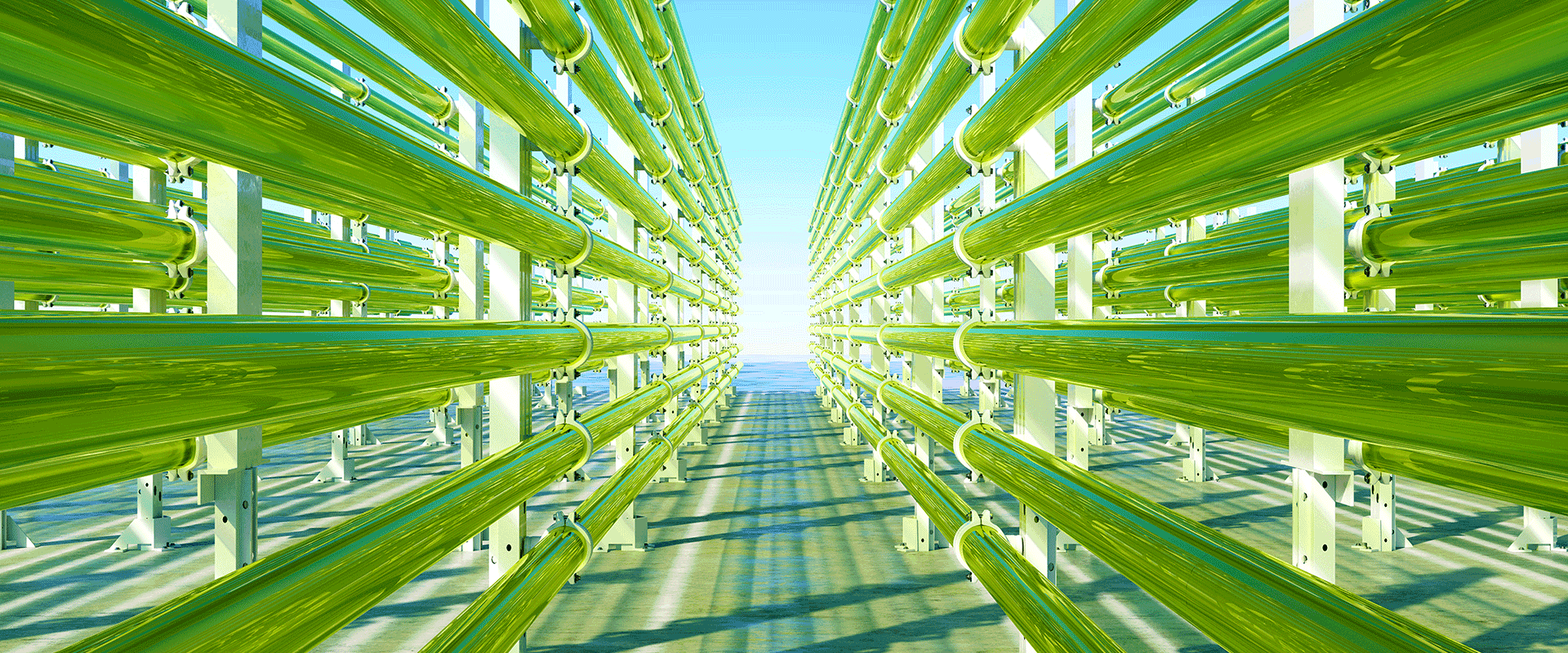

Carbon capture utilization and storage (CCUS) comes out on top, with 54% of respondents choosing this development. “We’ll be managing these [oil and gas] assets for a long time, so it’s important to reduce their impact on the environment through CCUS,” one executive told us. Next is hydrogen technology, which 46% put on their top-three list despite lingering issues with profitability and whether use cases will be proven out and appear compelling versus alternative technologies vying for similar positioning. A notable example of this is the battle between batteries, hydrogen, liquefied natural gas (LNG) and others for the decarbonization of long-haul transportation. After hydrogen, a third of respondents identify a continued focus on oil and gas, which underpins the industry’s positioning that oil and gas — despite policy and societal headwinds and carbon emissions that can only be abated with the aforementioned CCUS technology — remains an enormous opportunity for the industry even over the long term. While undoubtedly true in the short term in a tight supply, and surging demand, market for oil and gas that is pushing commodity prices ever higher, the pace of transitionary technology development may shape the true answer to this over time.

There’s less consensus around the next group of picks. Electric vehicle (EV) infrastructure is a top choice for 30% of our respondents — nearly tied with renewable and emerging fuels. Both reflect an emphasis on innovation — and perhaps energy portfolio risk mitigation — to manage the transition from traditional fossil fuels. These are followed by solar power, carbon trading and offsets, and battery and energy storage. Wind power garners the least support as a top investment opportunity, with only 17% of executives saying they view it as the biggest energy transition opportunity.

Those are the top-line results. But a look under the hood reveals that not everyone sees every opportunity the same way. An investment that’s a top-three priority must have some impact in the longer term, and that can vary by business (see Figure 1).

This brings us to two important questions: What are the capabilities across talent and technologies that oil and gas executives deem required to capture opportunities in the energy transition? And to what extent do oil and gas companies have these capabilities? We asked respondents about that, too, and we’ll share what they told us in our next article.