The face of the global higher education sector has changed drastically, with students from emerging markets increasingly opting to pursue an education overseas. This megatrend has had a considerable impact, not just for source markets, but also for key destination countries. Anglophone countries alone enroll 2.5 million-3 million international students per year out of a total of 5 million students studying abroad. However, with the pandemic disrupting physical mobility, new factors are shaping the world of international education.

Key source markets

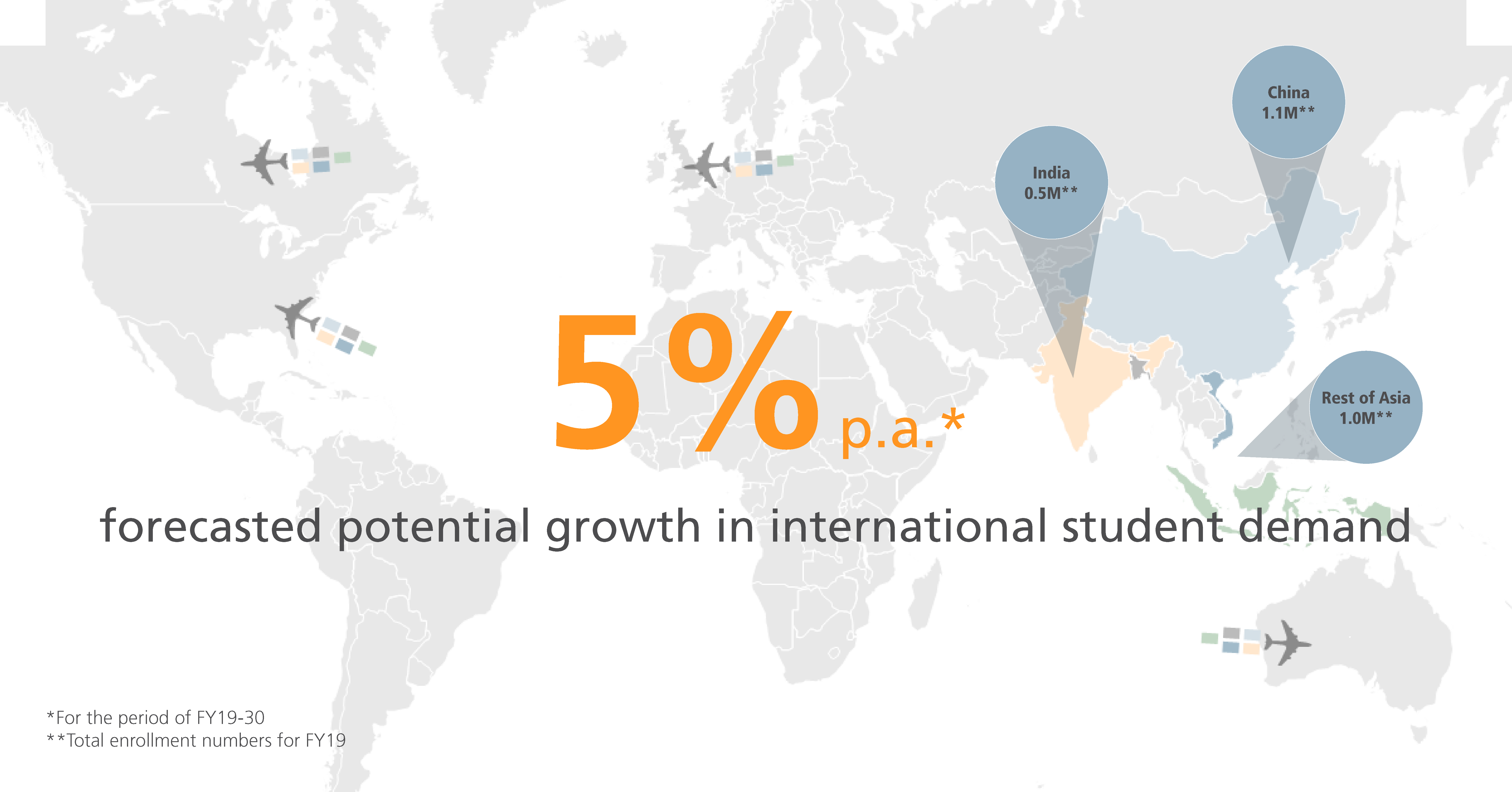

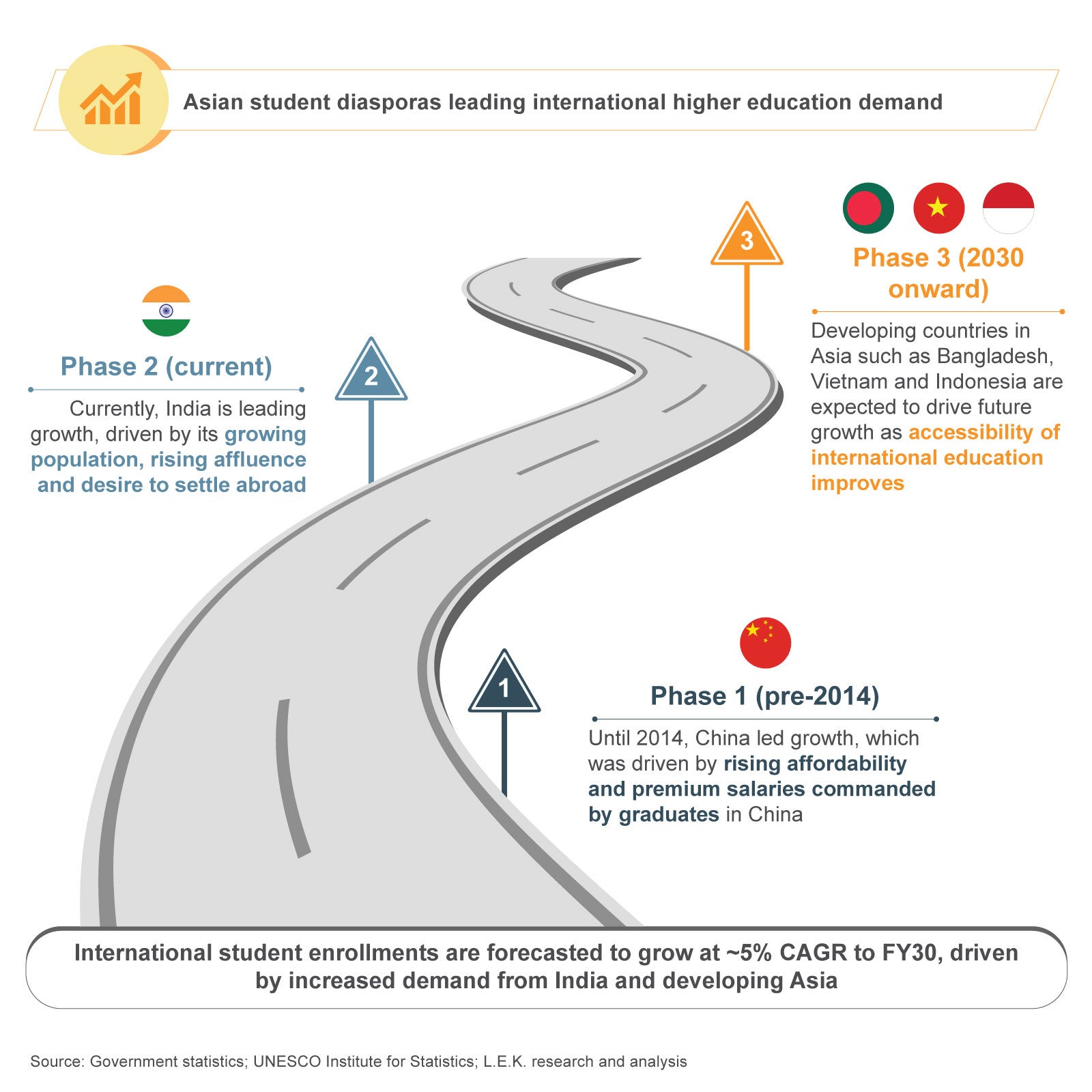

Students from various Asian countries represent most of the global demand for international higher education. China is the largest source market, with 1 million+ international students enrolled, and it has been a market leader for the better part of the past two decades. This is followed by India (~0.5 million students), which is the fastest-growing source market, with student enrollments predicted to grow at a compound annual growth rate of 8.5% (2019-2030). Following the trend of high demand are other developing Asian countries such as Bangladesh, Vietnam and Indonesia. International students from these countries currently total ~.065 million — a number that is forecasted to rise to more than 2 million by 2030.

There are several factors contributing to this impressive growth, including demographic trends, rising affordability and household incomes, poor quality of local education provision, improved accessibility of international education, premium salaries commanded by foreign graduates, and a greater desire to emigrate to Anglophone countries.

Key destination markets

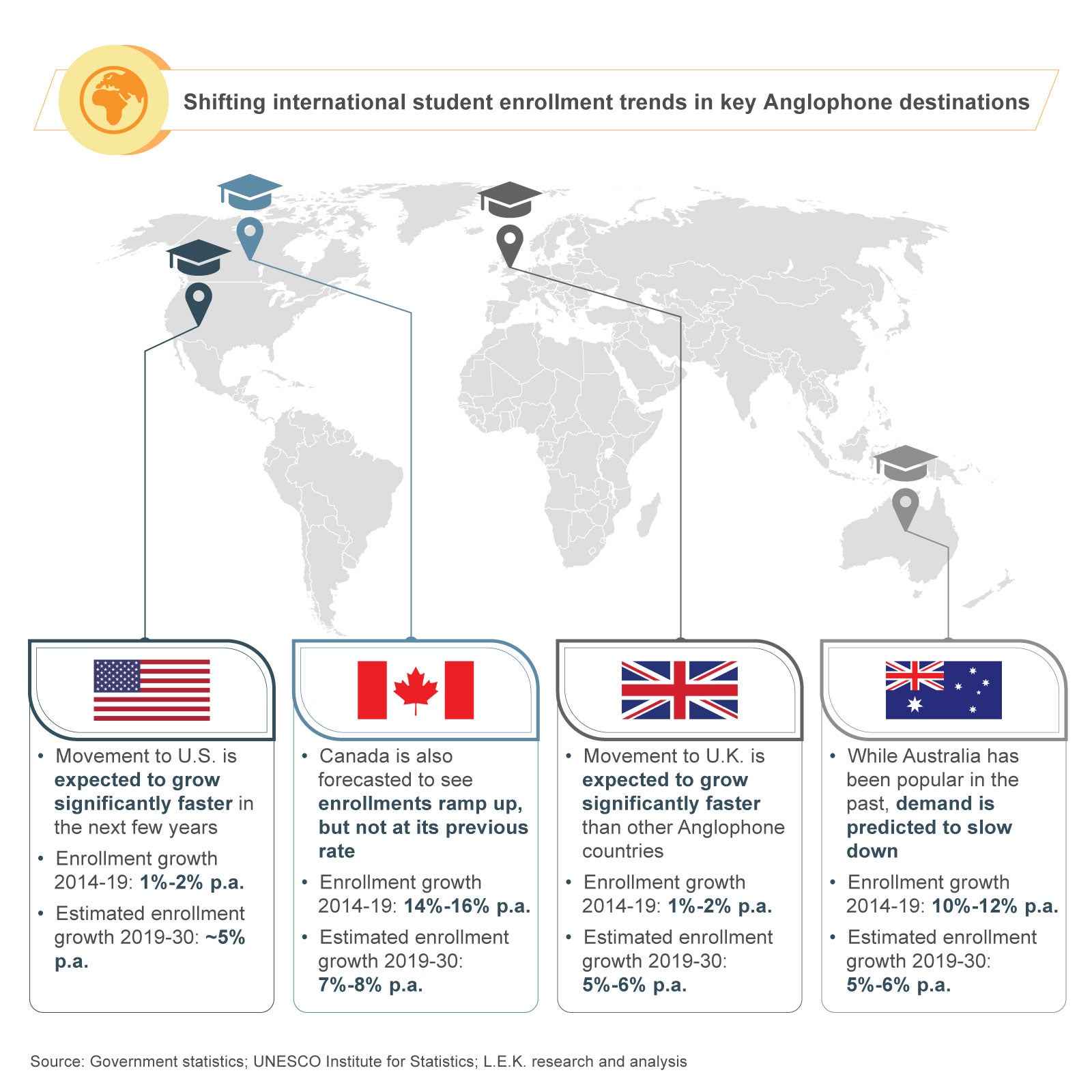

Most international students flock to a few key destination markets; prominent among these are Anglophone countries — the U.K., the U.S., Australia and Canada. While growth has been consistent for the most part, the pandemic has disrupted the market dynamics to a large extent.

While Australia is expected to see a slowdown in student enrollments due to border closures, key markets like the U.K. are set to capture this demand and gain a larger share of international students. Canada, which suffered lower enrollments due to the pandemic, is expected to be the fastest-growing market post-pandemic, albeit not as fast-growing as it was pre-COVID-19. Canada’s uptick is at the expense of U.S. universities, whose international enrollments are growing, albeit at a slower pace due to regulatory dynamics.

Conclusion

Although there are significant changes on both sides of the value chain (supply and demand), the broader global student mobility trends will remain largely consistent. Key Anglophone destinations will continue looking toward Asia as a primary source of international students, and demand will only increase from here on. As these markets move along the evolution curve of enrollment trends, value creation opportunities for investors and operators will continue to emerge.

01262022170127