Overview

As the healthcare landscape continues to evolve and present new challenges, many companies are finding that growth is slowing and profitability is declining from existing products and traditional approaches. L.E.K. has experience across the entire medtech value chain (from contract manufacturing to distribution to the actual provision of care), helping clients overcome many of the key challenges they face today and take advantage of distinct opportunities that are presenting themselves. Some of these challenges and opportunities include:

- Slowing U.S. healthcare spending growth: Cost pressures on the U.S. healthcare system are manifesting into slowing growth for medical device companies domestically, forcing medtechs to look abroad for new avenues of revenue growth, particularly in high-growth, emerging markets. However, incremental growth from emerging markets is unlikely to be sufficient to satisfy shareholders’ growth expectations, thereby forcing medtechs to revisit other nontraditional growth pathways and to access new revenue pools. With less than 8% of overall healthcare spending devoted to medical devices, medtechs have opportunities to expand their solutions, particularly those that reduce other cost components (e.g., reducing the pharmacological cost burden of expensive patient segments, reducing labor inefficiencies).

- Increased focus on accountability and value-based payments presents both an opportunity and a challenge for medtechs, as providers are forced to consider the total cost of care and look for medtech partners to help take on a larger role in driving down costs. Additionally, increased focus on accountability is further driving providers to consolidate into large health systems in order to drive cost efficiencies and to seek participation across the care continuum; while this provider consolidation is leading to opportunities for medtechs to focus selling efforts on large health systems, it also presents challenges for suppliers that must deal with more sophisticated procurement and standardization needs as well as heightened competition for the largest accounts.

- Traditional lines blurring across stakeholders in the medtech value chain: Medtechs may also be able to realize opportunities by redefining the boundaries of their businesses. This is reflected in how many large medtechs are expanding their service offerings and, in some cases, even providing care (e.g., Medtronic buying Diabeter), distributors expanding their own portfolios of manufactured products and selling their own branded products (e.g., Cardinal Health), and, conversely, some manufacturers vertically integrating into distribution (e.g., Bard acquiring Liberator Medical). GPOs are likewise expanding their service offerings (beyond contracting), and contract manufacturers of medical devices are also moving into upstream functions such as product design and prototyping.

- Medtech supplier consolidation: Consolidation among providers and pressures to provide broad portfolios of products present smaller players with both challenges and opportunities to compete in an increasingly concentrated competitive landscape.

- Increased focus on services and solutions: More so than with other types of suppliers to health systems, medtechs are particularly well-positioned to differentiate themselves as “solution” providers, solve key customer unmet needs and increase customer stickiness. There will be “losers” in the race to be preferred partners with leading health systems (that increasingly want fewer, deeper partners), but the benefits will be substantial as providers consolidate and worth the upfront investments to win the long game.

- Medtech commercial model evolution: Given the changes described above, medtechs are re-evaluating their approach to serving customers (e.g., through innovative gain-sharing models), and are also being forced to revisit their segmentation and targeting approaches to more effectively (and efficiently) serve customers that are changing in both their composition (e.g., increased administrator influence) and broader needs (e.g., dealing with growing accountability).

- Medtech evolution in pricing and contracting: Given the evolution in the provider landscape, medtechs are finding it more and more important to upgrade how they segment/tier their customers, as well as how they price their products and contract with their customers. Historically, high product margins and the dominance of fee-for-service reimbursement enabled medtechs to send armies of sales reps to sell to individual physicians with minimal focus on contracting strategies and pricing discipline. Although medtechs could “afford” GPO fees and pricing inefficiencies historically, they cannot anymore. As a result, medtechs are increasingly looking for ways to provide tiered pricing and service to customers, re-evaluate their existing GPO relationships and increase focus on direct contracting approaches with large health systems.

Given the above opportunities and challenges, we believe that changes in the healthcare landscape open new and profitable opportunities for companies that can successfully evolve. In this environment, medtechs must endeavor not only to maximize returns from their existing business but also to use their core competencies as the foundation for new sources of growth and opportunities.

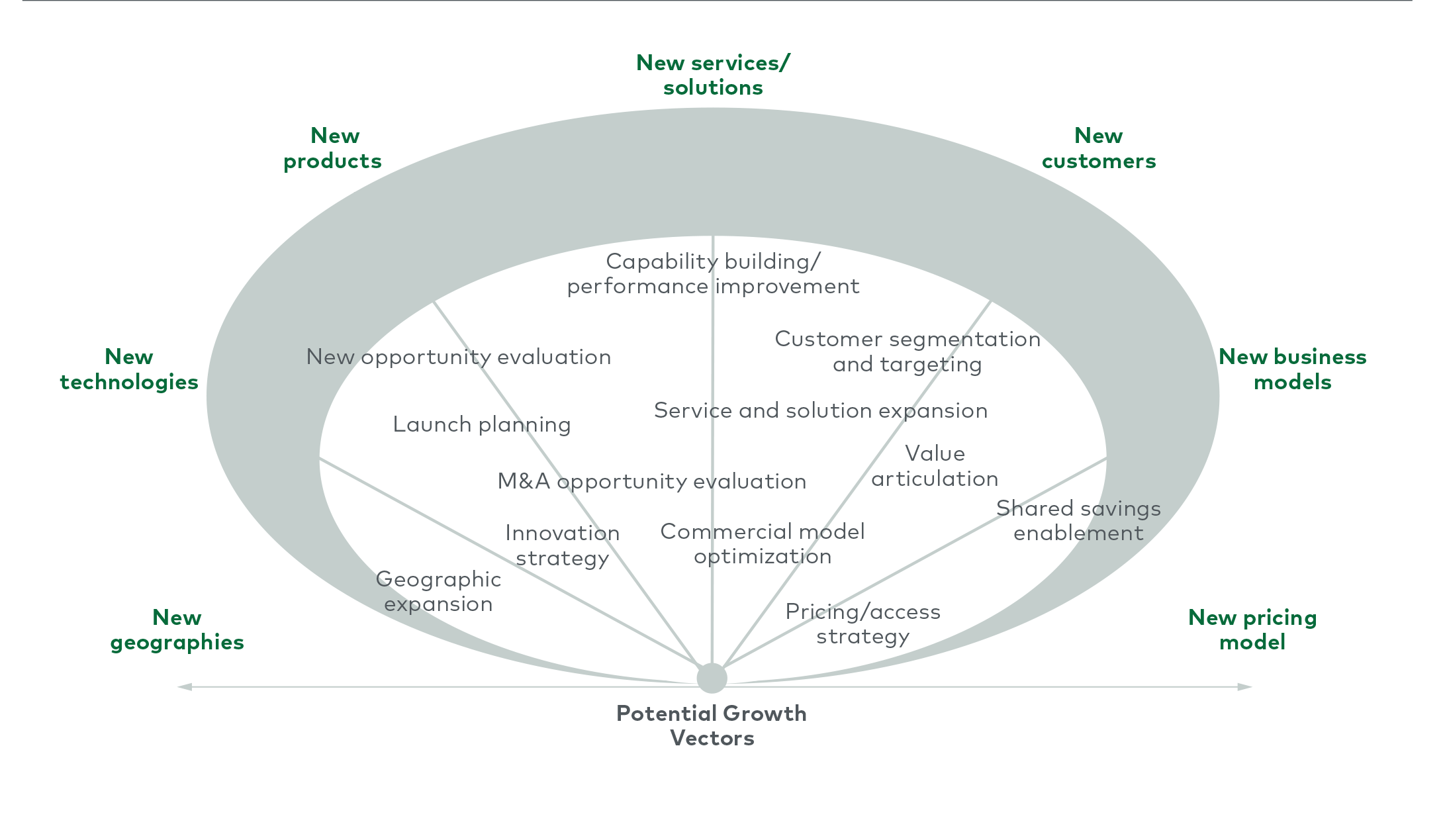

There are several different growth vectors that medtechs can pursue, but which one is right for your company? As a growth strategy consulting firm, L.E.K. has proven experience helping medtech companies navigate these questions, and employs deep research and sophisticated analytics to solve complex issues, distill key insights and, ultimately, deliver high-impact results.

Our diverse service offerings cover all avenues of growth strategy, and can be customized to help you pursue one or more of the strategic options that best fit your growth objectives and potential.

How we help

At L.E.K., helping clients grow their business and drive enhanced shareholder value is in our DNA. Our approach is customized for your unique situation and our team brings proven experience helping companies determine the best growth strategy. Our MedTech practice includes deep experience across all major product segments of the industry, including Consumables and Supplies, Medical Equipment, Procedure-Specific Devices, Healthcare IT and Drug Delivery Devices. Some of our core offerings across these segments include:

- Customer segmentation and targeting: Given the rise of consolidation, integration and increasingly varied provider models and needs, medtechs must understand the key distinctions between large, integrated payer-provider health system customers and the smaller, less sophisticated community hospitals; larger health systems may be seeking more long-term partnerships, whereas smaller hospitals may only be seeking a transactional relationship. We can help medtechs navigate this complex landscape, bringing to bear insights from our proprietary database of hospital systems, as well as our annual L.E.K. Hospital study.

- Service and solution expansion: Medical device companies are not only expected to provide innovative devices but are increasingly expected to do so as part of a broader solution that addresses a specific problem/need, whether clinical or operational in nature. Solutions should ideally incorporate the three elements of products, services and data and, ideally, should include ways to measure/track performance (if not explicitly linked to payments). We have extensive experience in helping medtechs expand into services and solutions across many hospital departments (e.g., OR, pharmacy, lab) and care settings (e.g., ASCs). We can help develop integrated solutions by prioritizing customers’ unmet needs and then defining the range of technologies, services and data required to address them. Moreover, we have deep experience in defining and implementing the organizational changes required to effectively deploy these new solutions.

- Commercial model optimization: In order to succeed in today’s healthcare environment, your organizational structure and commercial model must be customer-centric and well-aligned to the evolving needs of leading health systems. We understand the needs of these health systems and what they are looking for from their medtech partners. More important, we have advised medical device companies across all stages of development, helping them build out the organization and commercial infrastructure required to win in today’s market, which often includes redefining of commercial roles and rebalancing selling resources.

- Pricing strategy and value articulation: As healthcare moves to an outcomes-driven model, medtech pricing models are also shifting. To optimize market access and utilization, your pricing strategy and value articulation plan must be as precisely calibrated as your products. Our team supports the entire process, market by market, helping you effectively communicate the value of your product, anticipate and respond to payer reactions, and arrive at a clear strategy that pinpoints the right pricing levels and market entry strategy for maximum returns. Once products are in the market, we can help articulate the value of discrete products or broader solutions and/or help improve internal pricing strategies and associated processes.

- Transaction support: Large strategic companies (e.g., Medtronic, Stryker, BD, Abbott) have been particularly active over the past three years. Although some deals have focused on expansion within existing capabilities (e.g., Zimmer Biomet), most recent deals have been focused on acquiring new capabilities (often to enable migration toward more holistic “solutions” as described above). We are a leader in transaction support, helping both corporate and private equity clients. As a leading transaction support advisor, we have helped our clients execute more than $120 billion in life sciences and medical device deal value. We provide support at every step of the process, including M&A and partnership strategy, acquisition screening, commercial due diligence, negotiation support and post-merger integration. With respect to commercial due diligence, our reputation is second to none in delivering top-notch assessments of medtech target companies (both on the buy side and sell side) within extremely tight time frames.

- Product/market evaluation: Whether you are projecting revenues for your current product portfolio or weighing options for assets you might acquire or markets you might invest in, an independent, unbiased and evidence-based evaluation will provide you with the confidence required to make winning decisions. We apply a disciplined approach to product evaluation that combines quantitative analyses with qualitative research, and proprietary benchmarks, arriving at accurate projections that help you prioritize assets, allocate R&D investments and make rational go/no-go program decisions.